There is “no reason for any worries” in the global construction equipment and building material manufacturing industry despite a lack of growth in 2013, according to the German-based VDMA association. In a release issued after the association’s summer board meeting in Hameln, northern Germany, a VDMA spokesperson said, “Bauma, the industry’s leading international fair held in April, in particular helped to change the industry’s mood significantly. Directly or indirectly it led to a great number of new order

July 16, 2013

Read time: 3 mins

There is “no reason for any worries” in the global construction equipment and building material manufacturing industry despite a lack of growth in 2013, according to the German-based 1331 VDMA association.

In a release issued after the association’s summer board meeting in Hameln, northern Germany, a VDMA spokesperson said, “688 Bauma, the industry’s leading international fair held in April, in particular helped to change the industry’s mood significantly. Directly or indirectly it led to a great number of new orders, but in the meantime a downturn is visible again.”

Summing up the board’s common state of the industry view, the spokesperson added, “With the restrained forecast of the industry, this year’s scenario can probably best be interpreted to be a side movement. However, in light of the very good high absolute level the industry currently is on, there is no reason for any worries.”

With regard to construction equipment, the VDMA believes only the building construction market is growing. “In the last couple of weeks an increase in demand was visible in all areas. However, it has to be feared that the negative growth during the weak first quarter for earthworks and road construction machinery will probably have been too big to make a turnover result near zero for the entire year,” said the spokesperson. “The demand on building material machinery was higher in the first quarter of this year, compared to the same period last year, due to effects by special projects. Even if these should wear off slightly in the next couple of months, a growth for the entire year 2013 is still very realistic.”

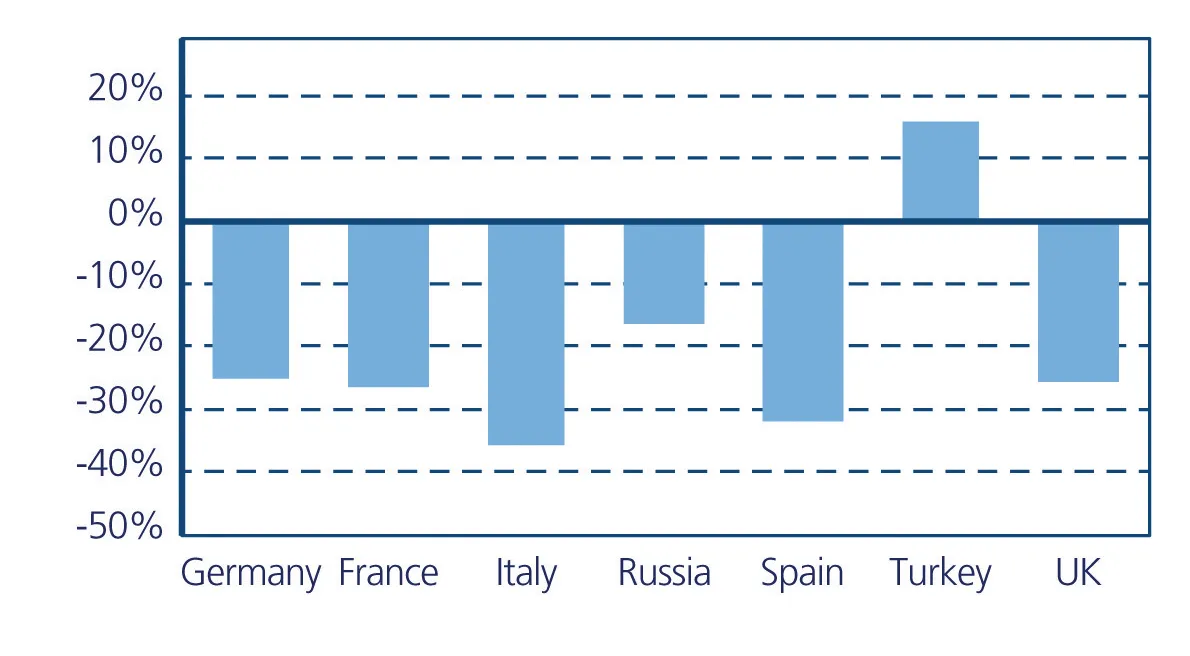

The Middle East, especially Saudi-Arabia, Russia - although with a slightly decreasing dynamic, the central Asian states and, with some cut-backs, North America and Brazil - are said by the VDMA to be among the markets that currently work the “most positively”. Germany, France and Scandinavia are said to remain rather stable. “At the negative end are, as before, the southern European countries. China and India are disappointing also: after a weak year 2012, there has currently not been a real upturn yet,” added the spokesperson.

The German construction equipment and building material machinery industry made US$16.31 billion (€12.5bn) in turnover in 2012. Of this, $10.31 billion (€7.9bn) was in construction equipment and $6 billion (€4.6bn) was in building material, glass and ceramics machinery.

In a release issued after the association’s summer board meeting in Hameln, northern Germany, a VDMA spokesperson said, “

Summing up the board’s common state of the industry view, the spokesperson added, “With the restrained forecast of the industry, this year’s scenario can probably best be interpreted to be a side movement. However, in light of the very good high absolute level the industry currently is on, there is no reason for any worries.”

With regard to construction equipment, the VDMA believes only the building construction market is growing. “In the last couple of weeks an increase in demand was visible in all areas. However, it has to be feared that the negative growth during the weak first quarter for earthworks and road construction machinery will probably have been too big to make a turnover result near zero for the entire year,” said the spokesperson. “The demand on building material machinery was higher in the first quarter of this year, compared to the same period last year, due to effects by special projects. Even if these should wear off slightly in the next couple of months, a growth for the entire year 2013 is still very realistic.”

The Middle East, especially Saudi-Arabia, Russia - although with a slightly decreasing dynamic, the central Asian states and, with some cut-backs, North America and Brazil - are said by the VDMA to be among the markets that currently work the “most positively”. Germany, France and Scandinavia are said to remain rather stable. “At the negative end are, as before, the southern European countries. China and India are disappointing also: after a weak year 2012, there has currently not been a real upturn yet,” added the spokesperson.

The German construction equipment and building material machinery industry made US$16.31 billion (€12.5bn) in turnover in 2012. Of this, $10.31 billion (€7.9bn) was in construction equipment and $6 billion (€4.6bn) was in building material, glass and ceramics machinery.