The tariff policy of the United States is causing great uncertainty in the machinery and equipment manufacturing sector, according to a survey by equipment manufacturers assocation the VDMA.

"The tariffs that US President Trump is already imposing on imports into the United States and may still want to impose have a major impact on the business of our member companies. But the global uncertainty, which American foreign policy has once again significantly increased these days, weighs just as heavily," says VDMA chief economist Johannes Gernandt. "The uncertainty not only affects trade with the United States, but also has an impact on other important sales markets, for example in Asia and Europe."

Of the companies surveyed, 87% do business with customers in the United States: around two-thirds have sales functions on US soil, 55% export directly from Europe/Germany and 34% have their own assembly or production facilities in the United States. Sixty per cent of companies currently rate their own competitiveness in the United States as good or very good compared to their main competitors. However, just under half of those surveyed (46%) believe that their competitiveness in the US market will deteriorate over the next 12 months.

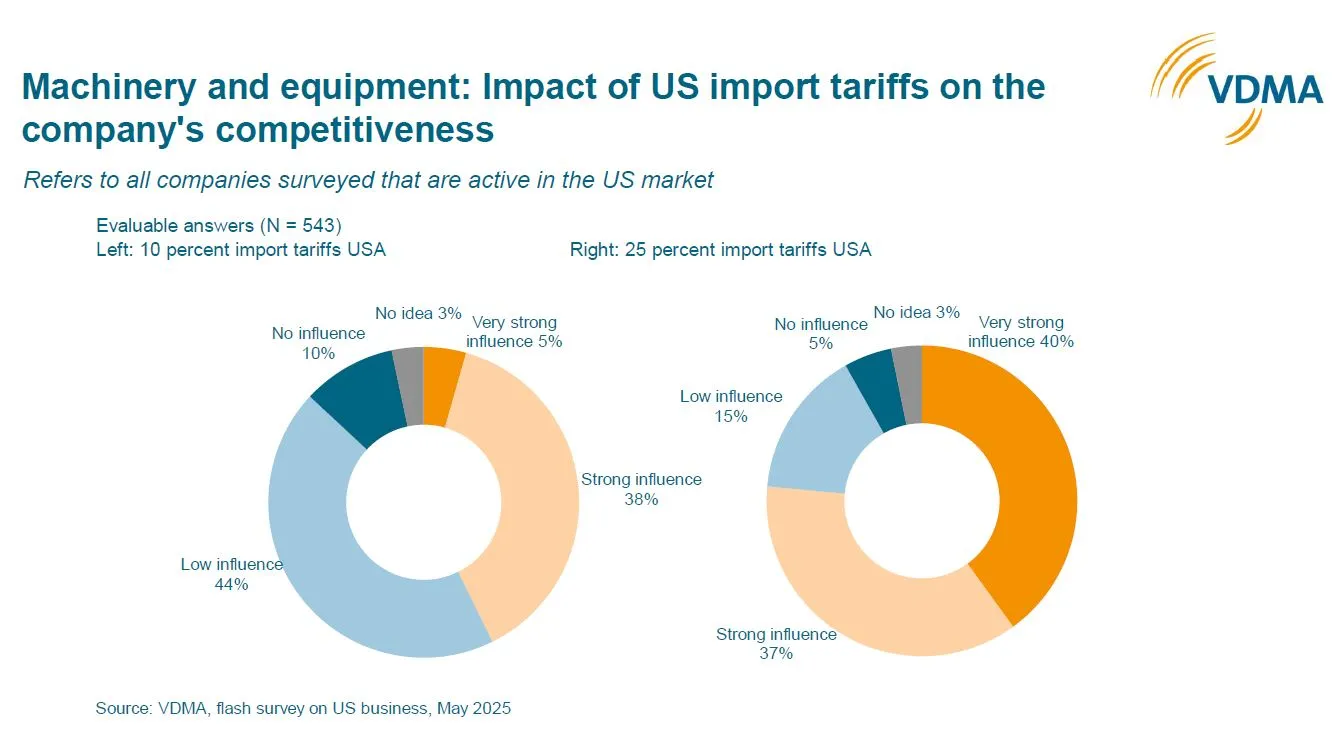

Tariffs of 10% or even 25% or higher on exports to the United States would have a strong impact on companies' competitiveness, according to the survey. With tariffs of 10%, 38% of companies see a strong influence and a further 5% a very strong influence on their competitiveness, while 44% of respondents expect a minor influence. Tariffs of 25% would have a much stronger impact. Here, 77% of companies see a strong or even very strong influence on their competitiveness.

"The EU and the USA should use the next few weeks to find a negotiated solution that is acceptable to both sides - and there is no room for high tariffs. Tariffs harm companies in both the EU and the United States. The machinery and equipment manufacturing industry is dependent on open markets," says Oliver Richtberg, head of the VDMA foreign trade department.

If no agreement is reached, the EU has held out the prospect of countermeasures. This would cover imports of almost all machinery and equipment products as well as the imports of steel and aluminum. More than half of companies (54%) fear negative or strongly negative effects on their own business, while 36% see no impact and 9% even expect countermeasures to have a positive effect.

The VDMA says its member companies are keeping a close eye on developments without getting carried away: Almost two thirds (62%) have no plans to modify their international business activities so far in response to the so-called 'Liberation Day' tariff announcements. However, 28% are planning responses, and one in ten companies is still undecided. India and the United States are mentioned slightly more frequently than other EU countries or Germany when it comes to possible relocations of business activities from the country of headquarters. Some companies are also reexamining their value chains. Those considering an adjustment are largely focusing on more local value chains, but reducing sourcing from China is also discussed.

Most companies are also not yet considering making any regional adjustments to their investment activities due to the latest economic policy developments in the United States: 68% do not intend to change their regional investment activities in Germany and 45% in other EU countries. In the United States and China, too, around 40% intend to leave things as they are for the time being. Companies that want to change their investments in Germany are more likely to consider a reduction (16%) than an expansion (9%). In the United States, they would rather increase them (22%) than reduce them (12%). In China, 16% would invest more and 9% less. In addition, 33% want to increase their investment activity in India.