Globalvia and APG have reached an agreement for the Spanish infrastructure Itínere Infraestructuras business. Under the terms of the deal, Globalvia will divest its entire stake in Itínere Infraestructuras to the APG Group. This transaction forms part of a set of agreements that solves outstanding litigation between the parties related to Itínere’s shareholdings.

These definitive agreements between Globalvia and APG reflect their commitment to setting a clear path forward. The successful completion of this deal represents a significant positive outcome for all parties involved.

Itínere Infraestructuras is a leading Spanish infrastructure management company. It operates 5 toll-road concessions in Northern Spain, totalling 525km. Additionally, Itínere holds the concession agreement for managing the operation, maintenance, and conservation of another toll road in the same region.

Globalvia first acquired a stake in Itínere on October 17, 2018, and increased its ownership to around 40% in 2019. APG, the asset management company and one of the largest pension investors, based in the Netherlands, previously held around 56% of Itinere through various entities.

DSCF0207

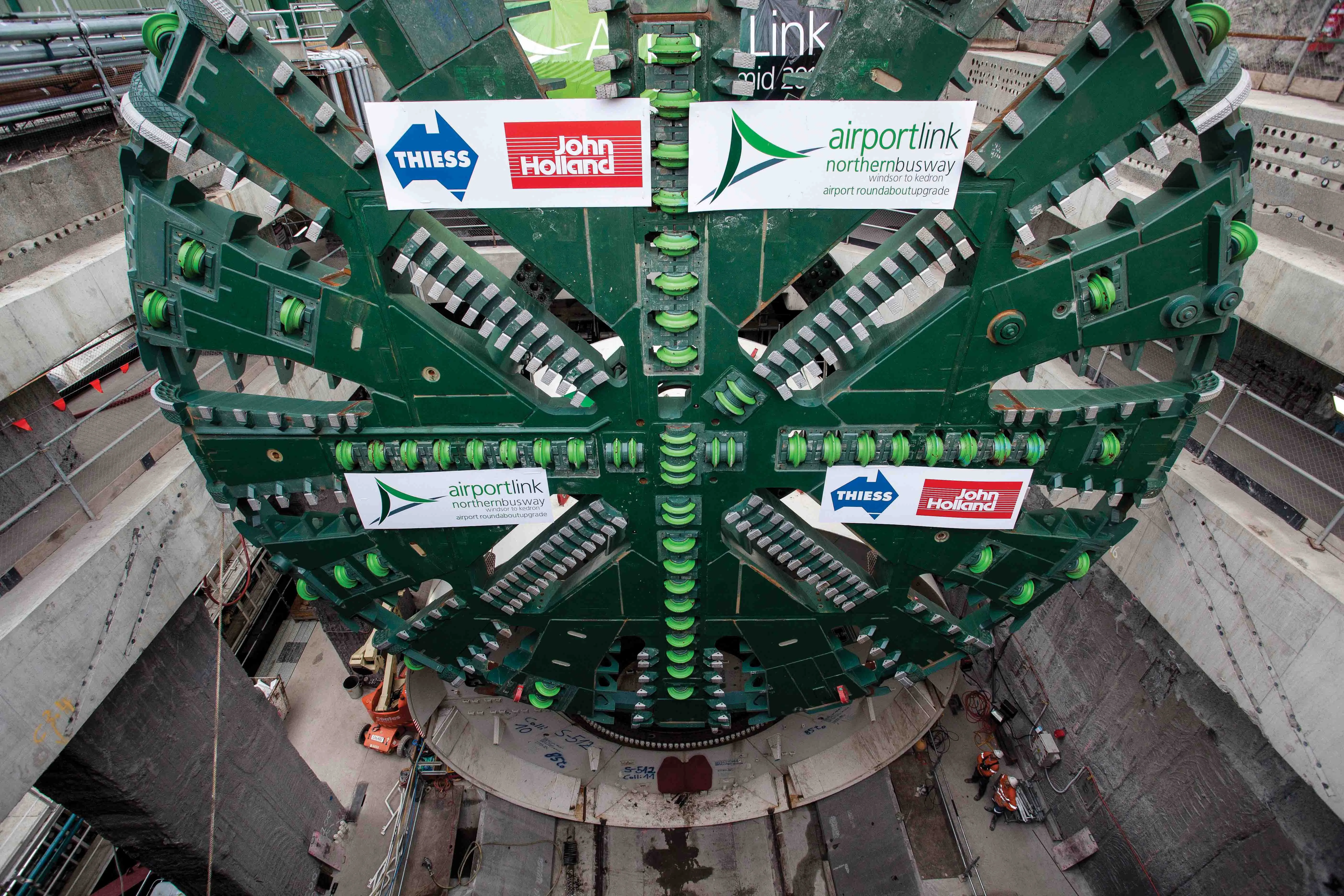

The APG Group is buying Globalvia’s stake in Spanish toll road firm Itínere Infraestructuras, image courtesy of Mike Woof