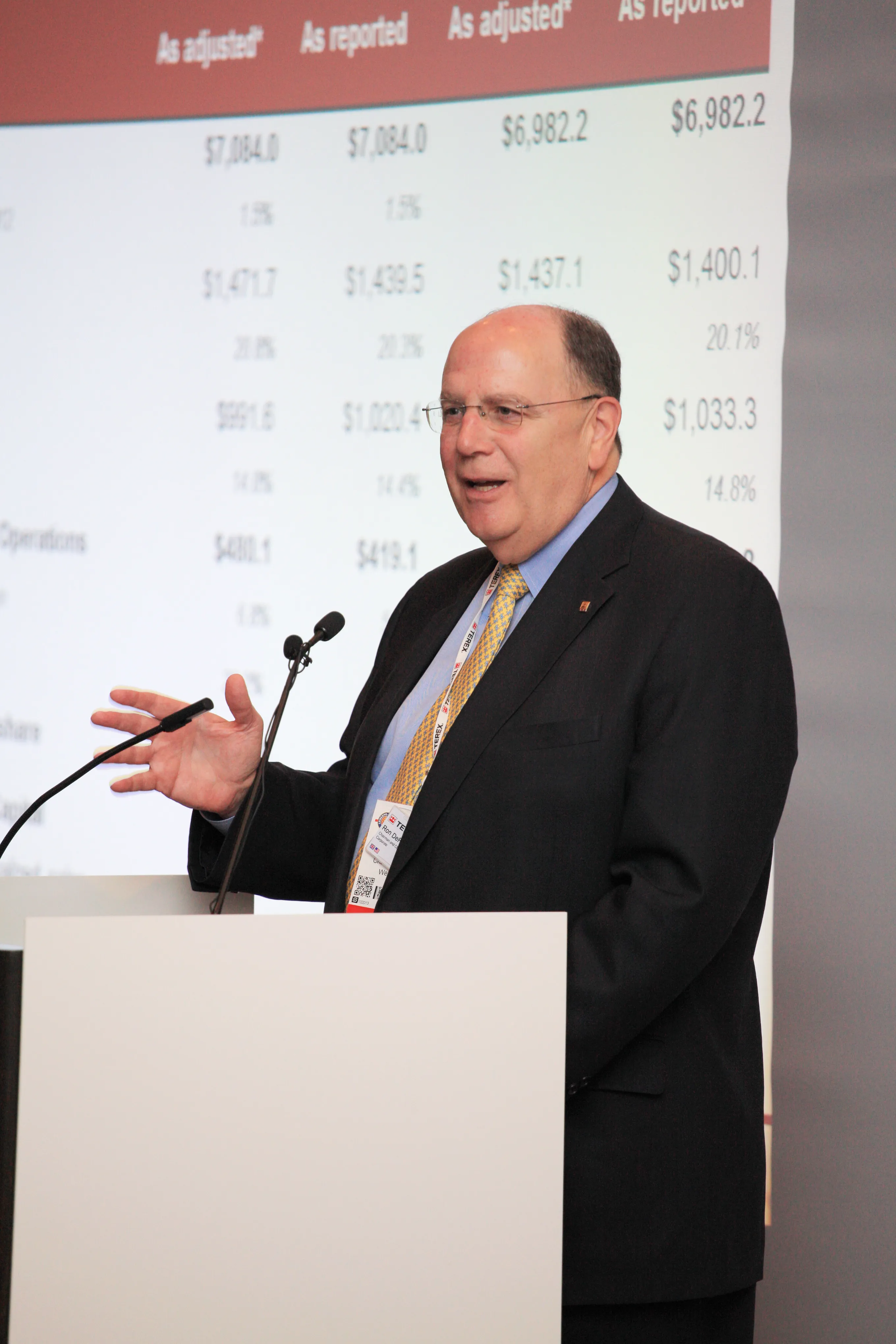

Terex president and CEO Ron De Feo was in an upbeat mood at the manufacturer’s Conexpo press conference this week saying “2013 was a year of pretty substantial improvement for our company.” In the second half of last year, Terex saw revenues grow by 6.1% with the figure for the whole year up by 1.5%. The aerial work platform (AWP) and materials handling and port solutions (MHPS) divisions led the improvement in the second half, said De Feo.

March 6, 2014

Read time: 2 mins

In the second half of last year, Terex saw revenues grow by 6.1% with the figure for the whole year up by 1.5%. The aerial work platform (AWP) and materials handling and port solutions (MHPS) divisions led the improvement in the second half, said De Feo.

And he predicted an even better performance in 2014. “There’s a lot of potential still in front of us,” he said.

Turnover in 2013 was $7.1bn, up from $6.9bn in 2012. “We achieved a return on our investment capital of about 8% and mean adjusted earnings per share of $2.23 compared to $1.58 in 2012,” said De Feo.

Business in North America is reviving, said De Feo. Revenues have grown by 24% since 2009, although not quite achieving the peak levels reached in 2007/2008. Western Europe, however, told a different story, with what De Feo described as a “bit of a double dip.” Earnings is Europea have remained fairly flat.

In the emerging markets of India, Brazil, Russia, China and Indonesia, Terex has been investing heavily in building sales service support … “but it’s expensive to chase that growth and tough to predict,” said De Feo. “They did suffer a little bit from the financial crisis but the developing market remains pretty strong. We are expecting business there to grow.”

De Feo’s plans for the future include further “simplification” of the business. The sale of the truck division for $160m to

%$Linker: