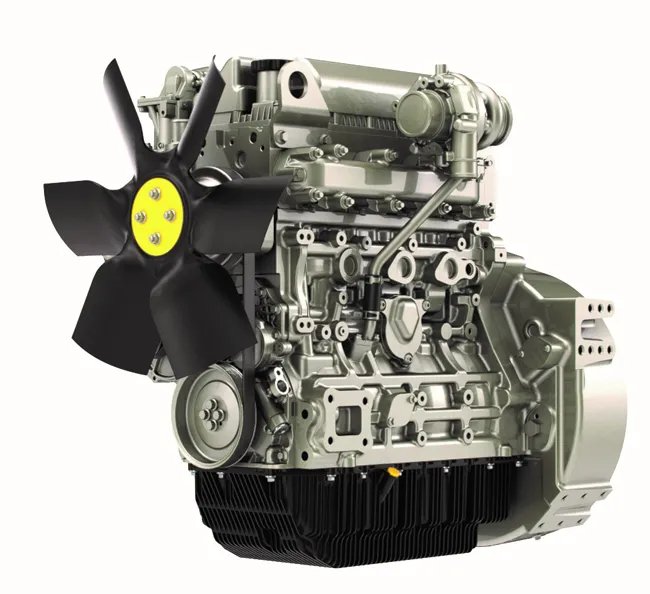

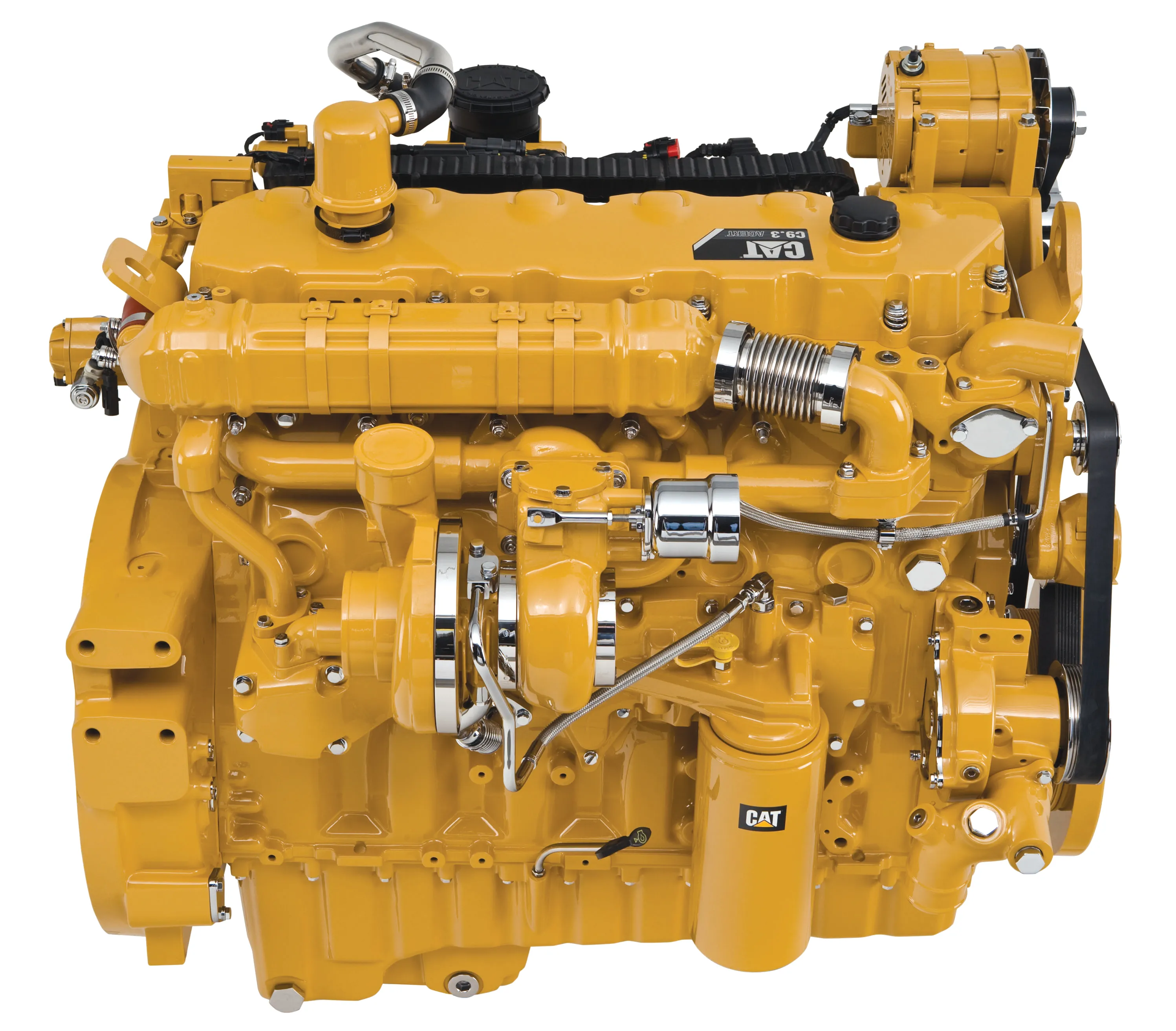

Over the last two decades, diesel engines have become more popular among European consumers, due to their higher fuel efficiency, lower CO2 emission values and fun-to-drive perception when compared to gasoline engines.

April 30, 2012

Read time: 3 mins

Over the last two decades, diesel engines have become more popular among European consumers, due to their higher fuel efficiency, lower CO2 emission values and fun-to-drive perception when compared to gasoline engines. Although these factors contribute to the high proportion of diesel engines in Europe, the principal drawback of diesel engines is the challenge in controlling particulate matter (PM) and emissions of oxides of nitrogen (NOx).

“European car manufacturers have adopted different strategies to reduce PM and NOx emissions, and one of those adopted is engine downsizing,” says research analyst, Bharath Kumar Srinivasan, from Frost & Sullivan. “However, downsizing a diesel engine will result in higher NOx emissions.”

Automotive OEMs therefore need to develop diesel engines, which meet low CO2 targets whilst complying with3287 EU emission standards (Euro norms) at the same time.

The PSA Group added a hybrid kit to a diesel powertrain and unveiled the diesel3504 Peugeot 3008 Hybrid4 with 200 bhp and CO2 emission as low as 99 g/km. The diesel powertrain produces a power output of 163 bhp and the electric motor generates an additional 37 bhp. Both powertrains are capable of running independently, thus offering the flexibility of using the all-electric mode within cities and making it a zero-emission vehicle.

Diesel hybridisation will be a significant trend toward meeting the 2020 targets of 95 gm/km, set by the European Commission. However, the higher costs of the technologies involved in a diesel hybrid, like the Hybrid4 technology, have been a key limitation to the launch of diesel hybrids. Attractive packaging is therefore expected to be a crucial proposition.

“PSA has managed to combine the best of technologies into a single package,” Srinivasan explains. “The Peugeot 3008 for instance, a crossover vehicle, allows multi-purpose use and is more practical for covering long distance (inter-city) travel. It therefore has an added advantage over electric vehicles, for which the driving range is often an issue – especially for travel between cities.”

With the leading volume brands -2729 Fiat, PSA, 2453 Renault & 3503 Volkswagen - all having a strong diesel portfolio, a joint development of diesel-hybrid solutions could prove beneficial. Not only does it lower development costs, it also offers the required economies of scale with the potential for large volumes. Alliances between automotive OEMs are therefore key, as they offer benefits ranging from product development to deployment. PSA's cooperation with 1233 BMW for hybrid components and the BMW-3992 Daimler-2456 GM joint development of the two-mode hybrid, although expensive, are successful examples for joint development. However, based on current market perspectives, the demand for diesel hybrids is set to grow to more than 300,000 units only by 2016-17.

The Hybrid4 from the PSA Group is a benchmark for other OEMs in the region that have similar, or in some cases different, strategies for adopting low-emission vehicles. True to its tradition of developing state-of-the-art diesel engines, it is the first OEM in the world that has introduced a diesel-hybrid powertrain. The PSA Group also plans to introduce plug-in hybrids in the future. Another French OEM, Renault, is likely to adopt a different strategy by introducing all-electric powertrains. Fiat, on the other hand, is likely to introduce gasoline 'MultiAir' and diesel 'MultiJet II' engines that include a 0.9 litre, 2-cylinder gasoline engine.

“The fact that high-volume OEMs such as Fiat, the PSA Group and Renault, which have already proven low fleet averages in the range of 125-140 g/km of CO2, are at the forefront of technology development is indicative of their dedication to reducing CO2 emissions,” concludes Srinivasan.

“European car manufacturers have adopted different strategies to reduce PM and NOx emissions, and one of those adopted is engine downsizing,” says research analyst, Bharath Kumar Srinivasan, from Frost & Sullivan. “However, downsizing a diesel engine will result in higher NOx emissions.”

Automotive OEMs therefore need to develop diesel engines, which meet low CO2 targets whilst complying with

The PSA Group added a hybrid kit to a diesel powertrain and unveiled the diesel

Diesel hybridisation will be a significant trend toward meeting the 2020 targets of 95 gm/km, set by the European Commission. However, the higher costs of the technologies involved in a diesel hybrid, like the Hybrid4 technology, have been a key limitation to the launch of diesel hybrids. Attractive packaging is therefore expected to be a crucial proposition.

“PSA has managed to combine the best of technologies into a single package,” Srinivasan explains. “The Peugeot 3008 for instance, a crossover vehicle, allows multi-purpose use and is more practical for covering long distance (inter-city) travel. It therefore has an added advantage over electric vehicles, for which the driving range is often an issue – especially for travel between cities.”

With the leading volume brands -

The Hybrid4 from the PSA Group is a benchmark for other OEMs in the region that have similar, or in some cases different, strategies for adopting low-emission vehicles. True to its tradition of developing state-of-the-art diesel engines, it is the first OEM in the world that has introduced a diesel-hybrid powertrain. The PSA Group also plans to introduce plug-in hybrids in the future. Another French OEM, Renault, is likely to adopt a different strategy by introducing all-electric powertrains. Fiat, on the other hand, is likely to introduce gasoline 'MultiAir' and diesel 'MultiJet II' engines that include a 0.9 litre, 2-cylinder gasoline engine.

“The fact that high-volume OEMs such as Fiat, the PSA Group and Renault, which have already proven low fleet averages in the range of 125-140 g/km of CO2, are at the forefront of technology development is indicative of their dedication to reducing CO2 emissions,” concludes Srinivasan.