Global engineering technology firm Reinshaw now has full ownership of UK-based Measurement Devices Ltd (MDL), following the purchase of an outstanding 34% shareholding for US$7.07 million (£4.5mn). The acquisition of the shares concludes an agreement reached in 2010, when Renishaw purchased an initial 29% stake in MDL, the designers and manufacturers of high speed laser measurement and surveying systems for use in extreme conditions. Steve Ball, the founder of MDL, will be leaving the company, whilst Elaine

February 5, 2013

Read time: 2 mins

Global engineering technology firm Reinshaw now has full ownership of UK-based 6239 Measurement Devices Ltd (MDL), following the purchase of an outstanding 34% shareholding for US$7.07 million (£4.5mn). The acquisition of the shares concludes an agreement reached in 2010, when Renishaw purchased an initial 29% stake in MDL, the designers and manufacturers of high speed laser measurement and surveying systems for use in extreme conditions.

Steve Ball, the founder of MDL, will be leaving the company, whilst Elaine Ball, MDL’s managing director, will report to Renishaw through Will Lee, director and general manager of Renishaw’s laser & calibration products division.

Ben Taylor, Renishaw’s assistant chief executive, said: “We see significant opportunities in the fields in which MDL operates and we are working hard to develop new measurement products based on our combined experience, to leverage our global sales and marketing networks, and to integrate our in-house design and manufacturing capabilities.”

MDL’s managing director, Elaine Ball, added: “We are now entering an exciting new phase in MDL’s 30-year history, and with the backing of the Renishaw Group we are very confident of continuing to expand in the global market for laser surveying and scanning measurement products.”

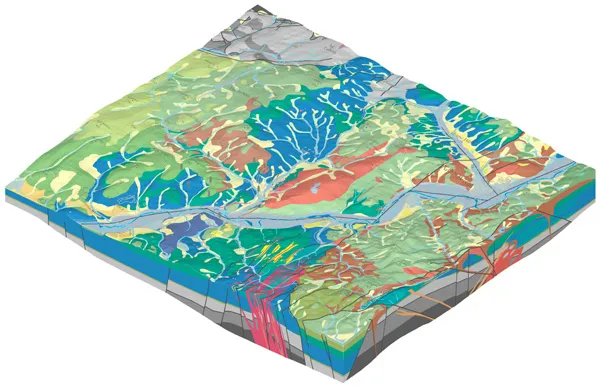

Established in 1983, MDL supplies a range of laser-based, time-of-flight measurement systems used in a wide range of applications worldwide in quarrying, mining, marine positioning, aviation, civil engineering and traffic control. In December 2012, to meet rising demand for its products, the company took occupancy of a new $4.71 million (£3mn) 1,858m² premises adjacent to its headquarters in York, northern England.

The company currently has around 70 staff at York and also has staff at offices in Scotland, Canada, Australia and the U.S.

Steve Ball, the founder of MDL, will be leaving the company, whilst Elaine Ball, MDL’s managing director, will report to Renishaw through Will Lee, director and general manager of Renishaw’s laser & calibration products division.

Ben Taylor, Renishaw’s assistant chief executive, said: “We see significant opportunities in the fields in which MDL operates and we are working hard to develop new measurement products based on our combined experience, to leverage our global sales and marketing networks, and to integrate our in-house design and manufacturing capabilities.”

MDL’s managing director, Elaine Ball, added: “We are now entering an exciting new phase in MDL’s 30-year history, and with the backing of the Renishaw Group we are very confident of continuing to expand in the global market for laser surveying and scanning measurement products.”

Established in 1983, MDL supplies a range of laser-based, time-of-flight measurement systems used in a wide range of applications worldwide in quarrying, mining, marine positioning, aviation, civil engineering and traffic control. In December 2012, to meet rising demand for its products, the company took occupancy of a new $4.71 million (£3mn) 1,858m² premises adjacent to its headquarters in York, northern England.

The company currently has around 70 staff at York and also has staff at offices in Scotland, Canada, Australia and the U.S.