The financial crisis may be easing but the geopolitical situation will continue to hamper heavy equipment sales for some years yet, according to David Phillips, head of Off Highway Research, based in the UK. Gone are the heady days of pre-2007, “when it was unbelievably easy to get credit” to buy machinery, Phillips told delegates during his presentation on day two of the Pavement Preservation and Recycling Summit in Paris this week. North America alone counted for up to half of world demand for equipment w

February 24, 2015

Read time: 3 mins

The financial crisis may be easing but the geopolitical situation will continue to hamper heavy equipment sales for some years yet, according to David Phillips, head of Off Highway Research, based in the UK.

Gone are the heady days of pre-2007, “when it was unbelievably easy to get credit” to buy machinery, Phillips told delegates during his presentation on day two of the Pavement Preservation and Recycling Summit in Paris (7924 PPRS 2015) this week.

North America alone counted for up to half of world demand for equipment which in 2007 hit US$112 billion globally. But by 2009, the situation had been turned on its head, with sales slumping to half that, around $64 billion. There was a peak in 2012 with sales around $119 billion, thanks to the Chinese market continuing to open up for major construction projects.

But, he explained, sales are expected to hover around $104 billion this year, although rise again to around $119 billion by the end of 2018.

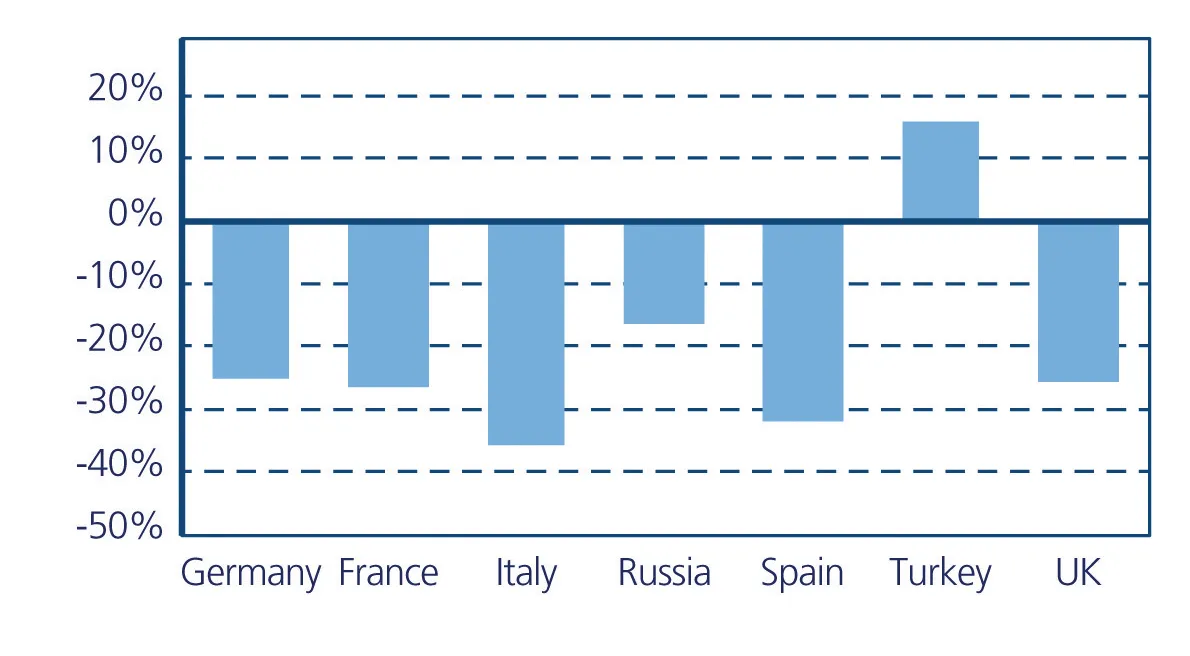

Despite his optimism of increased sales, he sounded a note of caution about the effect that international crises might have on regional sales. For example, he said, event in Europe that could affect sales are the stress testing of banks where their liquidity may be threatened and the ongoing struggle of Greece with its Euro partners over the country’s debt rescheduling – or not. Also, there is emergence of the so-called Islamic State terrorist groups in the Middle East that is destabilising governments and disrupting infrastructure plans. Exactly what shape the events in the Ukraine will take is still up for grabs, said Phillips.

As for the type of machines, he still sees the excavator being the machine of choice, especially the 20tonne variety, but with fast rising sales of compact excavators in the 6-10tonne range.

Phillips said that it’s hard to see China not remaining a very important market for sales, despite losing some of its growth rate. “I’m a great believer in India which, while maybe not as important as China, will remain a good source of sales as well as production,” he said.

Europe will remain flat although some countries, such as the UK, Germany and Scandinavia, will do well. Sales in North America, too, will remain fairly flat as federal and state governments continue to struggle over paying for road maintenance. While North America accounted for around 50% of global sales a decade ago, that is now about 30%.

Gone are the heady days of pre-2007, “when it was unbelievably easy to get credit” to buy machinery, Phillips told delegates during his presentation on day two of the Pavement Preservation and Recycling Summit in Paris (

North America alone counted for up to half of world demand for equipment which in 2007 hit US$112 billion globally. But by 2009, the situation had been turned on its head, with sales slumping to half that, around $64 billion. There was a peak in 2012 with sales around $119 billion, thanks to the Chinese market continuing to open up for major construction projects.

But, he explained, sales are expected to hover around $104 billion this year, although rise again to around $119 billion by the end of 2018.

Despite his optimism of increased sales, he sounded a note of caution about the effect that international crises might have on regional sales. For example, he said, event in Europe that could affect sales are the stress testing of banks where their liquidity may be threatened and the ongoing struggle of Greece with its Euro partners over the country’s debt rescheduling – or not. Also, there is emergence of the so-called Islamic State terrorist groups in the Middle East that is destabilising governments and disrupting infrastructure plans. Exactly what shape the events in the Ukraine will take is still up for grabs, said Phillips.

As for the type of machines, he still sees the excavator being the machine of choice, especially the 20tonne variety, but with fast rising sales of compact excavators in the 6-10tonne range.

Phillips said that it’s hard to see China not remaining a very important market for sales, despite losing some of its growth rate. “I’m a great believer in India which, while maybe not as important as China, will remain a good source of sales as well as production,” he said.

Europe will remain flat although some countries, such as the UK, Germany and Scandinavia, will do well. Sales in North America, too, will remain fairly flat as federal and state governments continue to struggle over paying for road maintenance. While North America accounted for around 50% of global sales a decade ago, that is now about 30%.