A key transport industry report has called for a 20-year transport infrastructure plan, while also highlighting the short-term need for more private sector investment.

March 14, 2012

Read time: 2 mins

A key transport industry report has called for a 20-year transport infrastructure plan, while also highlighting the short-term need for more private sector investment.

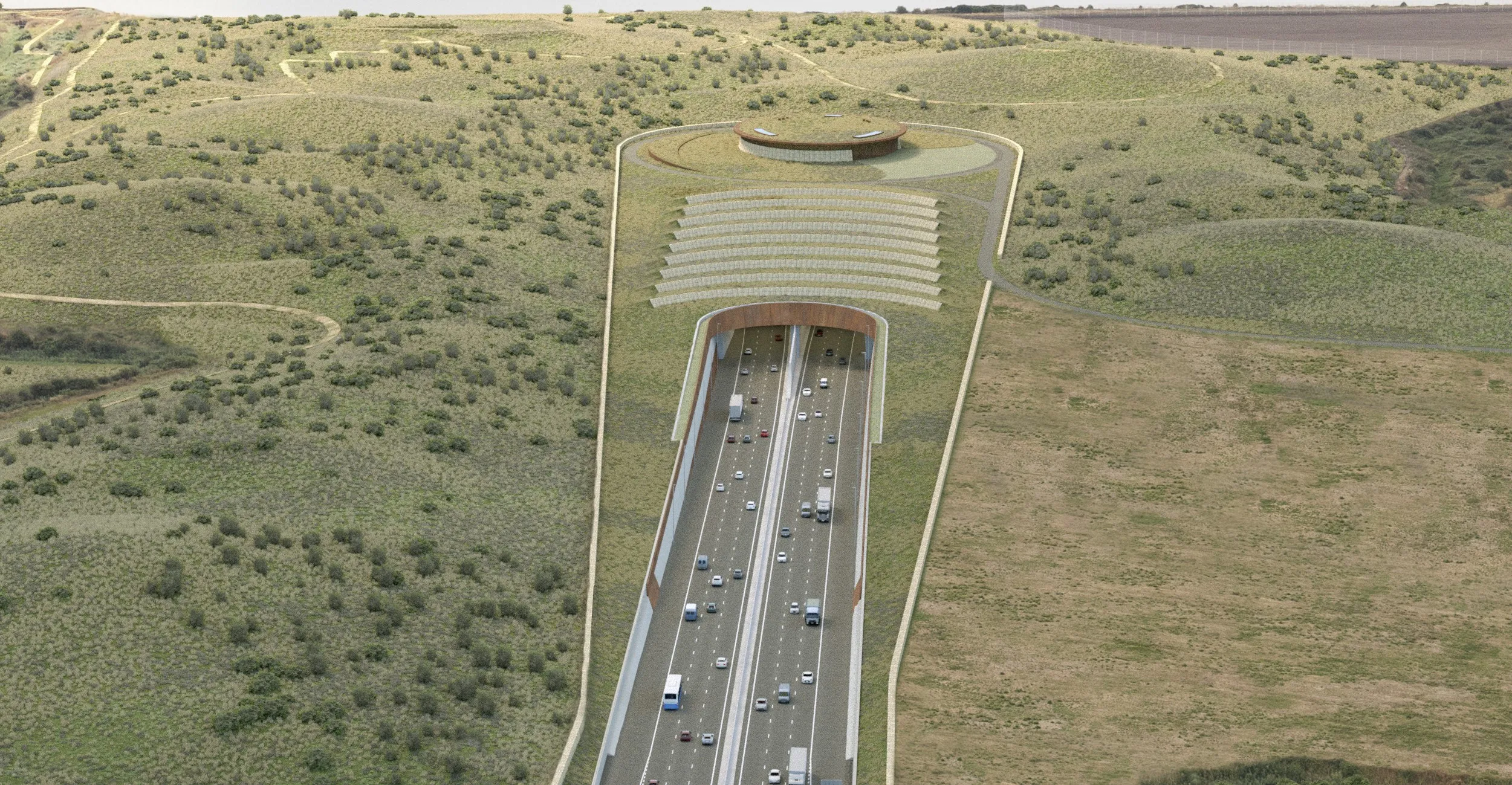

The Infrastructure Funding & Delivery: An Action Plan, compiled by the Chartered Institution of Highways & Transportation (CIHT) and infrastructure experts2693 Parsons Brinckerhoff and 1146 Balfour Beatty, claims the 20-year-plan would ensure successive governments commit to mechanisms that "attract private sector funding of transport improvements that serve existing developments and regeneration; and encourage the creation of a regulated private sector market for financing transport infrastructure”.

The report calls for gap and forward funding initiatives to generate greater private industry investment, more defined roles for Local Enterprise Partnerships and local authorities in infrastructure delivery, the green light for small scale congestion charging schemes showing “individual merit”, and the need to base future road user charging on current successful examples.

Sue Percy, CIHT chief executive said: "The funding and delivery of UK infrastructure needs to change to ensure that the infrastructure necessary for the UK to compete globally is in place, planned and improved over the short, medium and longer term.

"The report contains a number of recommendations including that the UK’s National Infrastructure Plan should be extended to include a 20 year timeline to help provide private investors with the confidence that they need. Our members have highlighted that this commitment alongside a clear and consistent message on where infrastructure is needed and likely to be financially viable are crucial in moving the agenda forward."

Further report recommendations include the need to create transport infrastructure investment portfolios to spread risk, and the need to provide a mechanism for local communities to invest in infrastructure that provides a “direct benefit and return".

Commenting on the Action Plan document Nick Flew, managing director, Parsons Brinckerhoff EUMENA, said: "Finding solutions and developing new models for infrastructure investment means clients, governments and the private sector must come together and agree a way forward. Unfortunately the UK’s status as a developed economy has perhaps made us complacent that increasing improvements in our existing infrastructure would always continue with minimal investment.

"The tough choices now needed to renew and increase the capacity of our infrastructure to support economic growth cannot be put off forever. How we meet this challenge will, in part, influence the security, prosperity and well-being of the UK for future generations."

The Infrastructure Funding & Delivery: An Action Plan, compiled by the Chartered Institution of Highways & Transportation (CIHT) and infrastructure experts

The report calls for gap and forward funding initiatives to generate greater private industry investment, more defined roles for Local Enterprise Partnerships and local authorities in infrastructure delivery, the green light for small scale congestion charging schemes showing “individual merit”, and the need to base future road user charging on current successful examples.

Sue Percy, CIHT chief executive said: "The funding and delivery of UK infrastructure needs to change to ensure that the infrastructure necessary for the UK to compete globally is in place, planned and improved over the short, medium and longer term.

"The report contains a number of recommendations including that the UK’s National Infrastructure Plan should be extended to include a 20 year timeline to help provide private investors with the confidence that they need. Our members have highlighted that this commitment alongside a clear and consistent message on where infrastructure is needed and likely to be financially viable are crucial in moving the agenda forward."

Further report recommendations include the need to create transport infrastructure investment portfolios to spread risk, and the need to provide a mechanism for local communities to invest in infrastructure that provides a “direct benefit and return".

Commenting on the Action Plan document Nick Flew, managing director, Parsons Brinckerhoff EUMENA, said: "Finding solutions and developing new models for infrastructure investment means clients, governments and the private sector must come together and agree a way forward. Unfortunately the UK’s status as a developed economy has perhaps made us complacent that increasing improvements in our existing infrastructure would always continue with minimal investment.

"The tough choices now needed to renew and increase the capacity of our infrastructure to support economic growth cannot be put off forever. How we meet this challenge will, in part, influence the security, prosperity and well-being of the UK for future generations."