Industry confidence – at least for the near future - is supported by performance of the European market, according to the latest CECE Barometer. Stable development at high levels in northern and western Europe underpins a continuing yet slowing recovery in southern Europe and fairly weak growth in Central and Eastern Europe. There are around 350 global OEMs operating in Europe and more than 85% of their worldwide production is done in this region. Half of these 350 OEMs have all their production in Europe.

February 9, 2017

Read time: 2 mins

Industry confidence – at least for the near future - is supported by performance of the European market, according to the latest 3399 CECE Barometer. Stable development at high levels in northern and western Europe underpins a continuing yet slowing recovery in southern Europe and fairly weak growth in Central and Eastern Europe.

There are around 350 global OEMs operating in Europe and more than 85% of their worldwide production is done in this region. Half of these 350 OEMs have all their production in Europe. European sales top €40 billion annually.

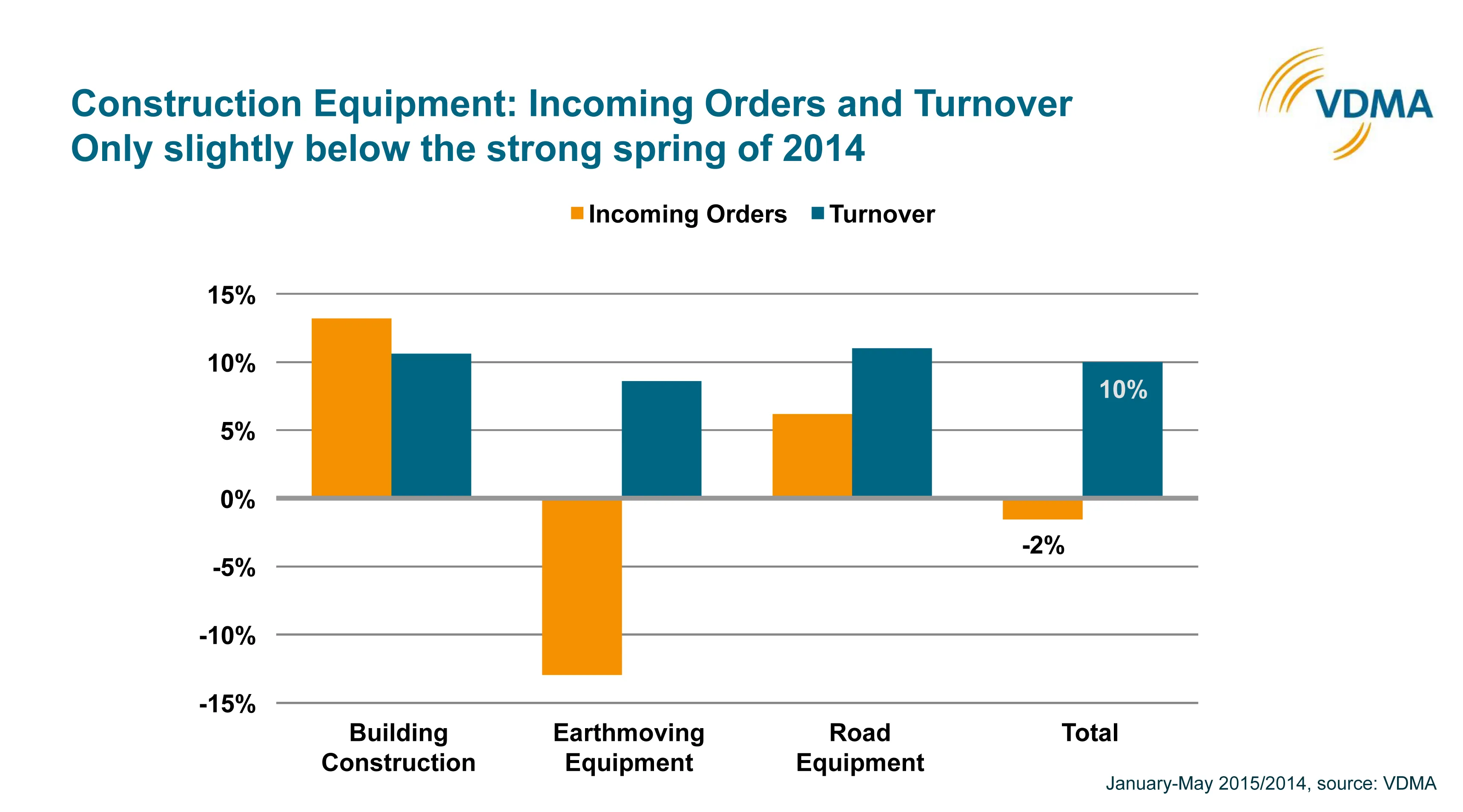

“Construction equipment sales in Europe recorded double-digit growth in the first half of 2016 compared to the same period in 2015,” said Holz. “The pick-up in demand extended to all construction equipment sub-sectors, with building construction equipment taking the lead, and to almost all markets in Europe.”

Despite the strong demand in the first half of the year, industry sentiment looking forward is more subdued. The CECE business climate index was back at positive levels in September, having digested a steep dip in July following the UK’s vote in June that was in favour of leaving the European Union, and after eight months of gradual improvement since the autumn of 2015.

Concrete equipment manufacturers are currently the most optimistic sub-group within the CECE Barometer, while road equipment manufacturers are least optimistic about growth. Demand from the mining sector continues to be very weak, which has a restraining effect on construction equipment sales.

But Holz remains optimistic. “Provided that general conditions within the sector and its customer industries do not change substantially in the coming months, CECE expects full-year growth for the European market of between 5-10%.”

There are around 350 global OEMs operating in Europe and more than 85% of their worldwide production is done in this region. Half of these 350 OEMs have all their production in Europe. European sales top €40 billion annually.

“Construction equipment sales in Europe recorded double-digit growth in the first half of 2016 compared to the same period in 2015,” said Holz. “The pick-up in demand extended to all construction equipment sub-sectors, with building construction equipment taking the lead, and to almost all markets in Europe.”

Despite the strong demand in the first half of the year, industry sentiment looking forward is more subdued. The CECE business climate index was back at positive levels in September, having digested a steep dip in July following the UK’s vote in June that was in favour of leaving the European Union, and after eight months of gradual improvement since the autumn of 2015.

Concrete equipment manufacturers are currently the most optimistic sub-group within the CECE Barometer, while road equipment manufacturers are least optimistic about growth. Demand from the mining sector continues to be very weak, which has a restraining effect on construction equipment sales.

But Holz remains optimistic. “Provided that general conditions within the sector and its customer industries do not change substantially in the coming months, CECE expects full-year growth for the European market of between 5-10%.”