Swedish manufacturer Volvo CE says it has continued its strong rebound from the challenges of last year with all markets except China seeing in uptick in sales from the same period 2020. China saw a slight slowdown despite its initial surge of sales in the first three months of the year.

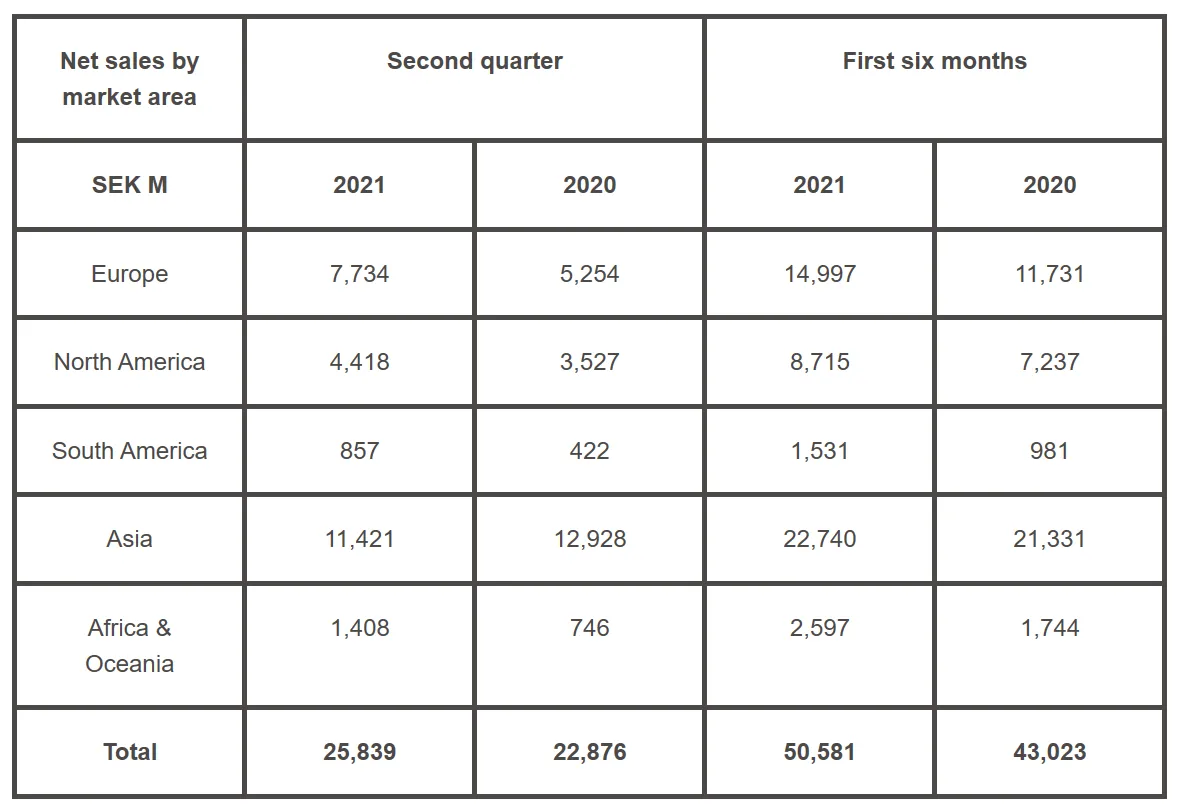

With improved construction activity, high customer confidence and increased investment in infrastructure, Volvo CE says its order intake has also increased by 35%. Total net sales in the second quarter increased by 13% amounting to SEK25,839m (€2522.35m), compared with SEK22,876m (€2233.06m) in Q2 2020. This was supported by a 17% rise in the sales of services. Adjusted for currency movements, however, net sales increased by 21%.

Sales in Asia, including China, the world’s largest construction equipment market, remained the highest but still accounted for a 12% drop, due to a decline in infrastructure investment. Asia (excluding China) continued to solidify its growth with improvements in all key markets including India, Korea and South East Asia. Adjusted operating income amounted to SEK3,374m (€329.36m), up slightly from SEK3,108m (€303.39m) last year, corresponding to an adjusted operating margin of 13.1% (13.6%).

Volvo CE says that a more confident customer outlook and increased investment across most markets saw order intake increase by 35%. It adds that there was a significant rise in orders for Volvo-branded products and a more modest yet stable order intake in SDLG branded products, affected as they were by the slowdown in the Chinese market.

Demand for large and medium-sized machines remained strong and higher than for compact machines. The manufacturer says this was due in large part to higher sales in Europe and North and South America, the latter of which saw a 120% increase in deliveries from the same period last year, overall deliveries increased by 5% in Q2.

Volvo CE says the year up to May has benefited from high customer activity across industry segments, more than positively impacted by increasing volumes in the European, North American and South American markets. In Europe, the majority of countries continued their recovery to see a 30% increase measured in units from the same period last year, while North America saw a 35% rise thanks to high infrastructure and housing construction activity. The South American market enjoyed the biggest surge (71%) due to an increased demand in commodities. Despite its strong start to the year, China began to decline in Q2 in line with decreasing government investment in infrastructure.

Melker Jernberg, president of Volvo CE, said: “Thanks to our commitment to innovation and customer success, we have offset a slowdown in China with a solid increase in demand across our other key regions of Europe and North America. While maintaining a steady recovery from the challenges of last year remains our top priority, we have also continued our journey of innovation with a number of exciting launches this quarter, including our entry into the 50 ton excavator segment and the launch of our first dedicated Fuel Cell Test Lab.”