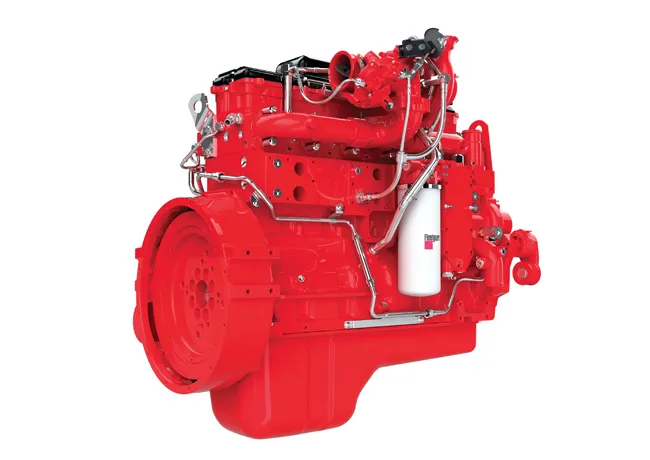

Cummins has showcased a full line of China Nonroad Stage IV emissions engines with the unveiling of the upgraded high performance 8.9-litre L series engine. The unit moves up to 298kW with a peak torque of 1800Nm – an 11% increase on its predecessor – and offers class-leading fuel economy and the ability to run at high altitudes while maintaining power capability.

Cummins full line-up of engines for the new China Nonroad Stage IV emissions standard spans 2.8 to 15 litres displacement with a power capabili

November 21, 2018

Read time: 4 mins

Cummins full line-up of engines for the new China Nonroad Stage IV emissions standard – due to come into effect in 2020 - spans 2.8 to 15 litres displacement with a power capability of 34kW to 503kW. The proven technology and platforms move easily from China Nonroad Stage III by leveraging the US Tier 4 Final and EU Stage V experience as well as on-highway NS VI. The China Stage IV engines do more with less, said to offer up to 10% increased power density with better transient performance for improved machine productivity. Improved reliability with best in class fuel economy delivers lower total cost of ownership.

For China Stage IV, the 4.5-litre to 6.7-litre B engines are available from 66-224kW. The 8.9-litre L engine is available from 151-298kW. The 12-litre and 15-litre X engines are available from 250-503kW. All these are suitable for a wide range of construction equipment including wheeled loaders, excavators, forklifts, cranes, drills, air compressors and road machinery.

“At Cummins we design our products to deliver the optimum balance of performance, reliability and cost that best fits the customer and market needs. Our significant technology experience has enabled us to select the most appropriate solution for China and the Stage IV emissions regulations,” said Dr. Lixin Peng, Cummins vice president - Engineering, China ABO. “Cummins’ China Stage IV engines are designed and developed for a wide range of applications. With our upgraded performance systems, we are able to achieve low emissions without compromising the ability of the engines to perform at the highest load factors or in the toughest conditions.”

Cummins electronic control system and unique air-intake to exhaust-out system capability has enabled seamless machine integration for the OEM, and easier emissions upgrade for their customers. With the common technology with Cummins EU Stage V, it makes next generation upgrade more flexible and easier, and offers more choices for the customers with full line of Cummins EU Stage V engines that will be dual certified to China Stage IV.

Cummins Emission Solutions brings aftertreatment technology expertise to support Chinese customers with optimum choices including Diesel Oxidation Catalyst (DOC), Diesel Particulate Filter (DPF) and Selective Catalytic Reduction System (SCR). “Over the past ten years Cummins has supplied SCR and DPF units to over 2 million vehicles and non-road equipment around the world. Over 7 billion hours and 265 billion kilometres of operation have been accumulated while reduced 4.26 million tons of NOx,” added Peng.

Cummins’ China Stage IV solution for 6.7-litre to 15-litre engines uses SCR technology and DPF plus DOC to significantly reduce Oxides of Nitrogen (NOx) and Particulate Matter (PM) emissions versus China Stage III units. The lower displacement engines adopt Exhaust Gas Re-circulation (EGR) combined with DOC and DPF for lower total cost of machine operations.

“There’s lots of interest among Chinese customers in the China Stage IV engines,” said Steve Nendick, Cummins marketing communications director. “There is also talk about whether some regions will get government funding to help customers replace their China Stage III models with Stage IV machine fleets.

“Our joint venture partners are also excited about the new commercial opportunities that China Stage IV is creating.

“Cummins is on course to see 15% higher global sales this year compared to last year, when sales were worth US$20 billion. China is one of the growth markets fuelling that.”

Nendick said Cummins Chinese sales are supported by the company’s long-established trading in the market, which they entered in 1975.

“Our technology centre in Wuhan [Hubei province, central China] is Cummins’ second largest technical centre globally. It is where all the China Stage IV engine rating development work has taken place.

“We are also working with a joint venture partner on a new assembly plan with engine testing facilities in Chongqing (southwest China), which is due to open at some stage next year. It will cater for our larger 50 litre engines, our 19 litre engines and some heavy-duty units.”