Preventing a decline in European construction equipment sales in 2013 appears to be “out of reach”, according to the Quarterly Economic Bulletin from the Committee for European Construction Equipment (CECE). The Q1 2013 bulletin from the lead organisation for representing and promoting the European construction equipment and related industries states that “far beyond anticipated” first quarter sales declines were likely due to a particularly long and cold winter in many parts of Europe and the industry awai

June 17, 2013

Read time: 3 mins

Preventing a decline in European construction equipment sales in 2013 appears to be “out of reach”, according to the Quarterly Economic Bulletin from the 2440 Committee for European Construction Equipment (CECE).

The Q1 2013 bulletin from the lead organisation for representing and promoting the European construction equipment and related industries states that “far beyond anticipated” first quarter sales declines were likely due to a particularly long and cold winter in many parts of Europe and the industry awaiting the bauma 2013 exhibition – said to serve as a platform for innovation as well offering a sales climate indicator. On a more upbeat note, the CECE says that manufacturers reported very good order intake at and after688 Bauma, particularly in demand from North America and the Middle East, supporting the assumption that construction equipment sales will improve in Q2 2013.

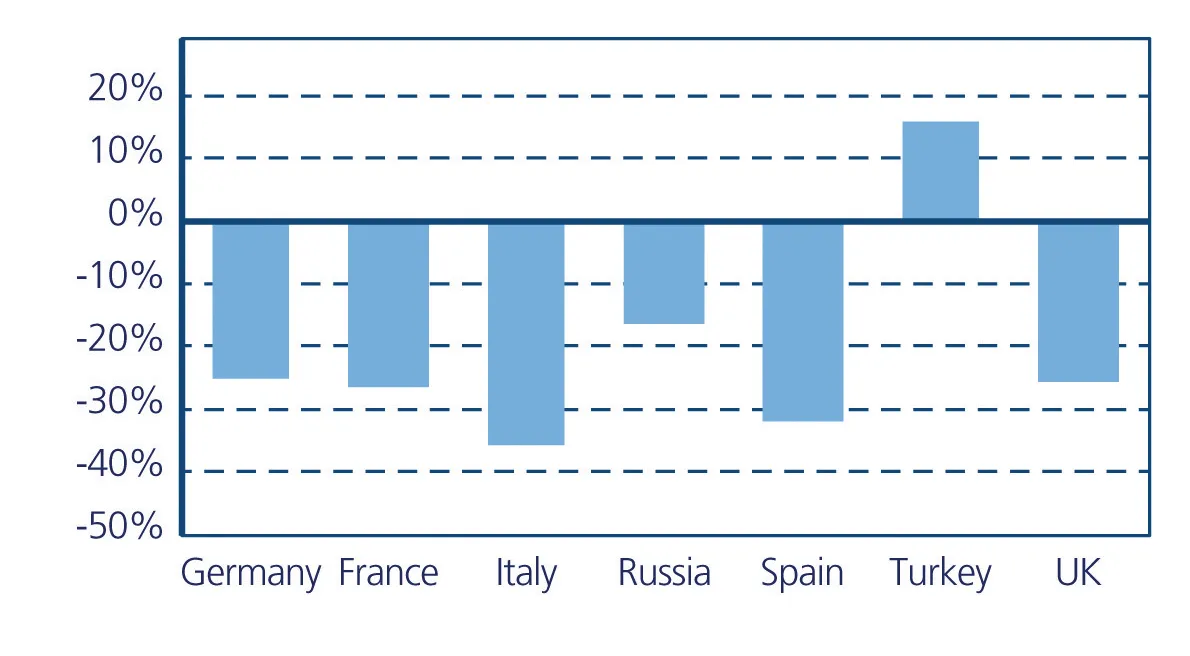

But despite increased OEM confidence in future sales pushing the business climate index of the CECE’s Business Barometer over the zero line, and Turkey and Russia remaining growth engines, albeit less so than before, for European sales, the CECE outlook for 2013 remains downbeat.

“Even under a very optimistic scenario with good growth in the next quarters, it will be very difficult to compensate the early deteriorations over the year, particularly for earthmoving (-20% in Q1 2013 to 32,500 units, excluding telehandlers) and road equipment (-30% compared to the same period of 2012),” the Bulletin states. “Therefore, a flat development across all regions and products for this year appears to be out of reach. Even if it seems to conflict at first sight with the improved business confidence, single to double-digit sales declines in 2013 are much more realistic.”

The CECE says that Off Highway Research, the management consultancy specialising in the research and analysis of international construction, and agricultural equipment markets, supports the CECE’s conclusions, having recently updated its 2013 and 2014 forecasts to show a 6% dip in European construction equipment sales this year, followed by a flat 2014. All products are tipped to see sales declines, with mini excavator sales being the hardest hit. Sales growth is only expected in Denmark and Norway and, after the bottom is hit, in the “small markets” of Ireland and Portugal.2444 Off-Highway Research warns that these predictions need to be questioned in the context of very bad first quarter results.

Off-Highway Research analysts are said by CECE to be more optimistic about rental industry investment; yet sees the lack of business confidence as a result of the ongoing Euro crisis and financing difficulties as major reasons for enduring market weaknesses.

On the subject of construction equipment production in Europe, the CECE also offers encouragement in its Q1 2013 Bulletin stating, “The scenario should be a bit more positive in the near future. Most manufacturers and distributors report that stock levels are back on a normal level. Growth in markets around Europe will further help to stimulate production, both because of direct exports to growth in regions and by the flow of used equipment that generates demand for new machines in Europe.”

The Q1 2013 bulletin from the lead organisation for representing and promoting the European construction equipment and related industries states that “far beyond anticipated” first quarter sales declines were likely due to a particularly long and cold winter in many parts of Europe and the industry awaiting the bauma 2013 exhibition – said to serve as a platform for innovation as well offering a sales climate indicator. On a more upbeat note, the CECE says that manufacturers reported very good order intake at and after

But despite increased OEM confidence in future sales pushing the business climate index of the CECE’s Business Barometer over the zero line, and Turkey and Russia remaining growth engines, albeit less so than before, for European sales, the CECE outlook for 2013 remains downbeat.

“Even under a very optimistic scenario with good growth in the next quarters, it will be very difficult to compensate the early deteriorations over the year, particularly for earthmoving (-20% in Q1 2013 to 32,500 units, excluding telehandlers) and road equipment (-30% compared to the same period of 2012),” the Bulletin states. “Therefore, a flat development across all regions and products for this year appears to be out of reach. Even if it seems to conflict at first sight with the improved business confidence, single to double-digit sales declines in 2013 are much more realistic.”

The CECE says that Off Highway Research, the management consultancy specialising in the research and analysis of international construction, and agricultural equipment markets, supports the CECE’s conclusions, having recently updated its 2013 and 2014 forecasts to show a 6% dip in European construction equipment sales this year, followed by a flat 2014. All products are tipped to see sales declines, with mini excavator sales being the hardest hit. Sales growth is only expected in Denmark and Norway and, after the bottom is hit, in the “small markets” of Ireland and Portugal.

Off-Highway Research analysts are said by CECE to be more optimistic about rental industry investment; yet sees the lack of business confidence as a result of the ongoing Euro crisis and financing difficulties as major reasons for enduring market weaknesses.

On the subject of construction equipment production in Europe, the CECE also offers encouragement in its Q1 2013 Bulletin stating, “The scenario should be a bit more positive in the near future. Most manufacturers and distributors report that stock levels are back on a normal level. Growth in markets around Europe will further help to stimulate production, both because of direct exports to growth in regions and by the flow of used equipment that generates demand for new machines in Europe.”