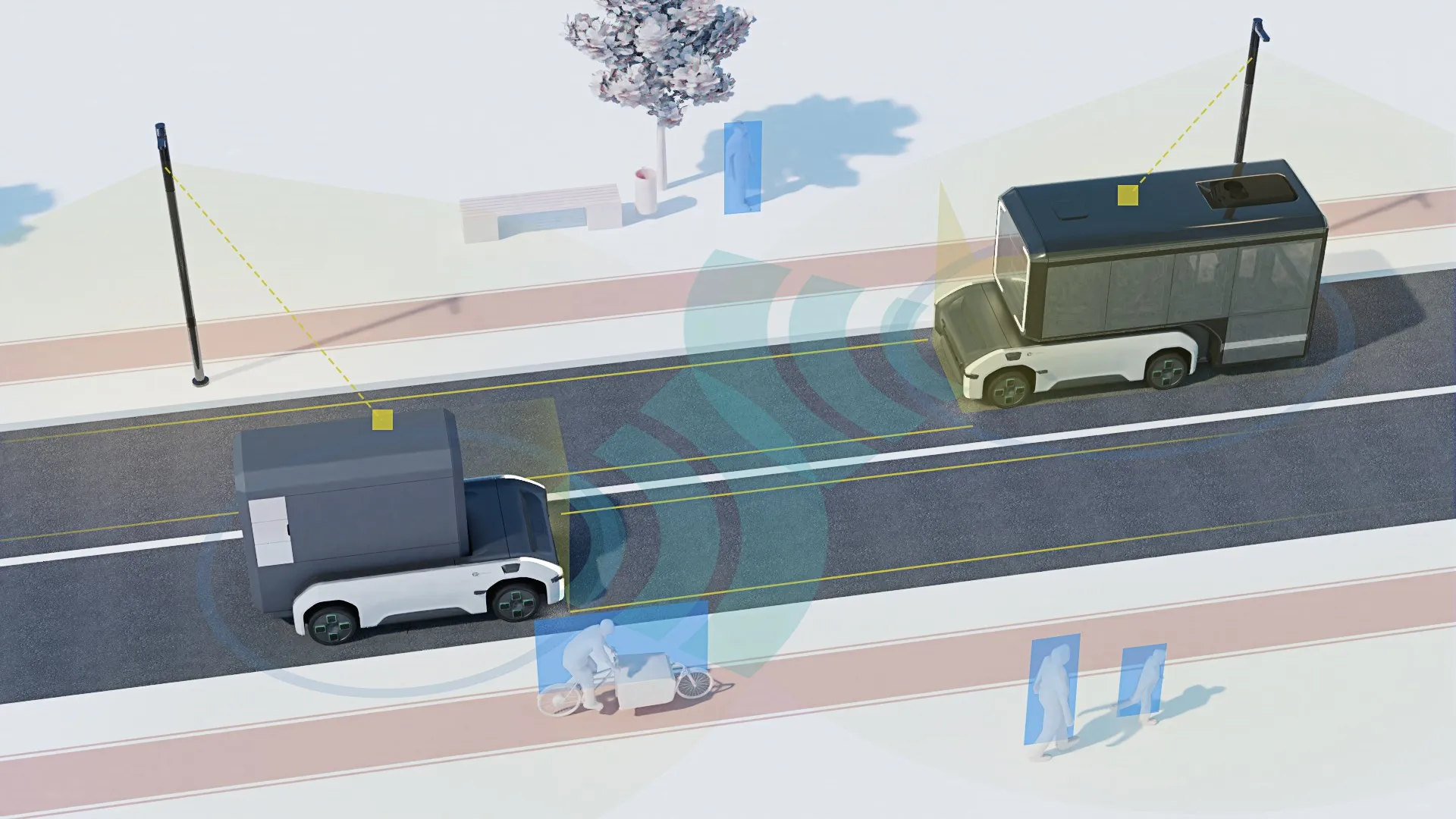

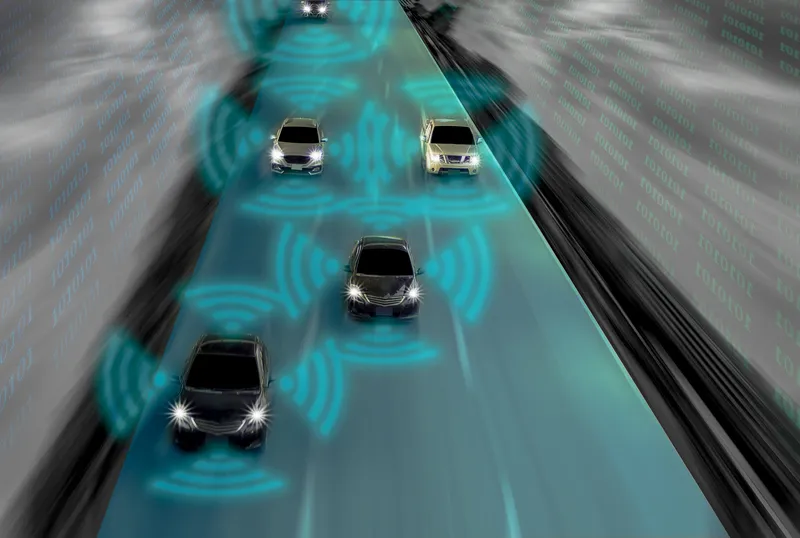

Technology features that use sensors to watch around the vehicle have become common on luxury vehicles in recent years, but now availability is spreading to the mainstream higher-volume segments such as the Ford Focus and Mercedes B-Class. Camera image analysis continues to get more powerful and radar sensors are getting cheaper, with Lidar and ultrasonics still in the mix.

May 4, 2012

Read time: 2 mins

Technology features that use sensors to watch around the vehicle have become common on luxury vehicles in recent years, but now availability is spreading to the mainstream higher-volume segments such as the 3423 Ford Focus and 2796 Mercedes B-Class. Camera image analysis continues to get more powerful and radar sensors are getting cheaper, with Lidar and ultrasonics still in the mix.

“One of the important developments in the last year or so has been the introduction of additional features,” says ABI Research principal analyst David Alexander. “For example, cross traffic alert adds significant benefit to the blind spot detection function, as road sign recognition does to lane departure warning (LDW).”

Consumer awareness is growing, and most world regions are updating their New Car Assessment Programs (NCAPs) to reflect the availability of the latest accident prevention features. But the roll-out of new features has mainly been driven by the automakers up to now. In partnership with tier one suppliers, the option cost has been steadily coming down and this trend is expected to continue for the next few years.

“Increasing availability of advanced driver assistance system (ADAS) features is also being driven by legislation and NCAP specifications,” says Dominique Bonte, group director, telematics and navigation. “For example, in the EU, new commercial vehicles are required to have enhanced blind spot vision, lane departure warning, and automatic emergency braking. In the US, after changes to NCAP, new car stickers are now required to indicate if certain ADAS features (LDW and forward collision warning) are available.”

Analysis of statistics shows that many traffic accidents could be avoided with help from ADAS technology that is now available. There are few financial incentives to encourage new vehicle buyers to specify ADAS features at present. The biggest beneficiaries of the widespread use of accident avoidance technology are insurance companies, who should be monitoring the situation closely.

ABI Research’s study, Advanced Driver Assistance Systems, provides an analysis of global market trends, cost and technological evaluations of all the major driver assistance systems, and discussion of existing product announcements. System volume and value forecasts for installations are provided globally, by region, through 2020.

“One of the important developments in the last year or so has been the introduction of additional features,” says ABI Research principal analyst David Alexander. “For example, cross traffic alert adds significant benefit to the blind spot detection function, as road sign recognition does to lane departure warning (LDW).”

Consumer awareness is growing, and most world regions are updating their New Car Assessment Programs (NCAPs) to reflect the availability of the latest accident prevention features. But the roll-out of new features has mainly been driven by the automakers up to now. In partnership with tier one suppliers, the option cost has been steadily coming down and this trend is expected to continue for the next few years.

“Increasing availability of advanced driver assistance system (ADAS) features is also being driven by legislation and NCAP specifications,” says Dominique Bonte, group director, telematics and navigation. “For example, in the EU, new commercial vehicles are required to have enhanced blind spot vision, lane departure warning, and automatic emergency braking. In the US, after changes to NCAP, new car stickers are now required to indicate if certain ADAS features (LDW and forward collision warning) are available.”

Analysis of statistics shows that many traffic accidents could be avoided with help from ADAS technology that is now available. There are few financial incentives to encourage new vehicle buyers to specify ADAS features at present. The biggest beneficiaries of the widespread use of accident avoidance technology are insurance companies, who should be monitoring the situation closely.

ABI Research’s study, Advanced Driver Assistance Systems, provides an analysis of global market trends, cost and technological evaluations of all the major driver assistance systems, and discussion of existing product announcements. System volume and value forecasts for installations are provided globally, by region, through 2020.