Francesco Micci discusses innovation in funding methods

All countries need an efficient and extended road transport system to sustain both the social development and the economic competitiveness. The latest trends show that the demand for road infrastructure is constantly growing, despite the negative impact of the financial and economic crisis on public and private financing. Global spending regarding road transport infrastructure actually accounts for roughly US$580 billion worldwide, and is projected

July 5, 2016

Read time: 4 mins

RSSFrancesco Micci discusses innovation in funding methods

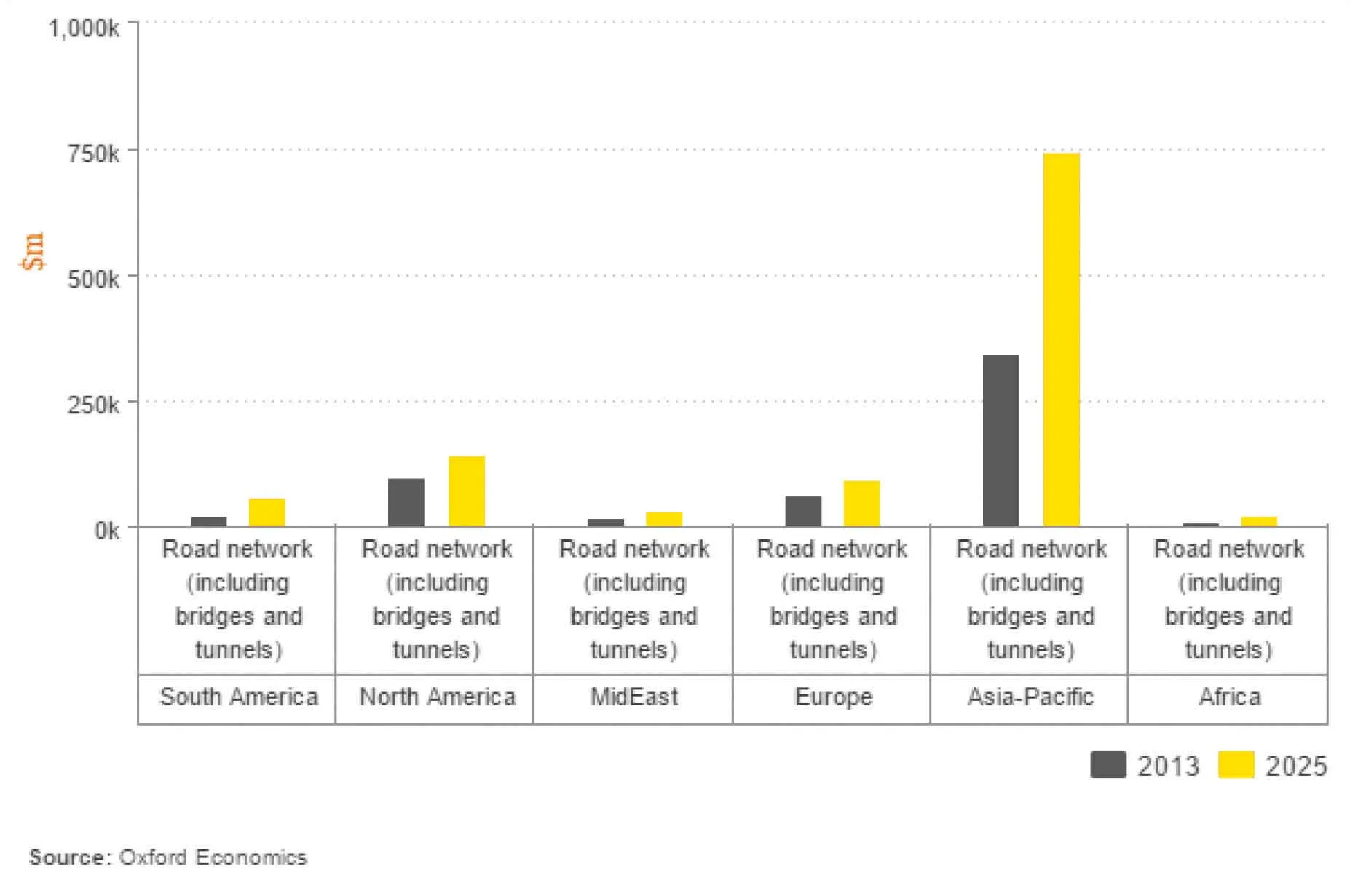

All countries need an efficient and extended road transport system to sustain both the social development and the economic competitiveness. The latest trends show that the demand for road infrastructure is constantly growing, despite the negative impact of the financial and economic crisis on public and private financing. Global spending regarding road transport infrastructure actually accounts for roughly US$580 billion worldwide, and is projected to quickly increase up to $ 1.13 trillion in 2025.

Developing economies are continuing to grow, in particular, Asia’s share of global road infrastructure spending is expected to rise from 59.5% in 2013 to to 65.5% by 2025.

The increase in road users will boost spending in Latin America and Middle East markets too, while Africa’s road investments will remain limited (2.09% by 2025). The weight of Western Europe (10.5%) and North America (17.2%) is becoming less important, in fact they’ll account for only 8.1% and 12.7% respectively over the coming decade. The trends (2013-2025) appear clear when looking at the road spending expressed as percentage of the GDP across world regions.

Emerging economies represent the biggest opportunities for road system development, but there are some worries about a possible slowdown related to sluggish growth in the advanced economies. Budget constraints will limit government investments on infrastructure, and the private sector may be called upon to contribute in traditional public sector spaces. However, the crisis has affected the number of users willing to pay too; so good governance of existing road systems and innovative financing mechanisms for new projects become primary.

Traditionally road infrastructure funding has been primarily borne by the public sector either using money from the general budget or funds from other particular sources (local taxes, fuel taxes, taxes on new vehicle acquisitions, and vehicle registration licenses). Given the shortage of funding because of the impact of the global financial crisis (reduction of taxes), the role of the private sector has been steadily increasing. Many countries turn to tolling as a primary way to raise funding, and advancement in technology are opening the way for future financing methods (extending tolling to the full network, “free-flow”, user-charging models based on road use). Road Authorities have also increased the range of contractual arrangements to engage the private sector.

Public-Private Partnerships (PPPs) have been one of the solutions identified. PPPs comprise various schemes (BOT, DBFO) differentiating on financial and contractual obligations, but the key common feature is the sharing of the risks between the public and the private entity. PPPs may also generate improvements in operative efficiency through better management. They are however, complex, heavily dependent on traffic and revenue forecasts and so often successful only if applied to main road projects.

Generally, the cost of private financing (and expected equity rates) are decreasing, but there are still difficulties in accessing credit. It seems as if different financing mechanisms and guarantees are to be put in place by governments or financial institutions in order to enlarge and secure private financing. Innovative financing mechanisms can consider capital instruments (investment funds, development banks, and state infrastructure banks), debt instruments (credit assistance, corporate bonds, and guarantees) or other innovative methods (value capture).

The objective is to provide risk capital or bank credit to projects of common interest. For example, in the EU, it is pursued by the use of project bonds and principal risk-sharing instruments such as LGTT (loan guarantee instrument for TEN-T projects) to finance transport projects involving investors in the long term. PPPs and other private sector financing mechanisms ought to be seen as a supplement to traditional public funding rather than as a substitute. Finding the perfect balance between public and private funding will be the greatest challenge worldwide over the coming decades.

Francesco Micci,1201 IRF Geneva Young Professionals Programme - Road Finance & Economics Group

For the full report, please contact the IRF – Young Professionals Programme

All countries need an efficient and extended road transport system to sustain both the social development and the economic competitiveness. The latest trends show that the demand for road infrastructure is constantly growing, despite the negative impact of the financial and economic crisis on public and private financing. Global spending regarding road transport infrastructure actually accounts for roughly US$580 billion worldwide, and is projected to quickly increase up to $ 1.13 trillion in 2025.

Developing economies are continuing to grow, in particular, Asia’s share of global road infrastructure spending is expected to rise from 59.5% in 2013 to to 65.5% by 2025.

The increase in road users will boost spending in Latin America and Middle East markets too, while Africa’s road investments will remain limited (2.09% by 2025). The weight of Western Europe (10.5%) and North America (17.2%) is becoming less important, in fact they’ll account for only 8.1% and 12.7% respectively over the coming decade. The trends (2013-2025) appear clear when looking at the road spending expressed as percentage of the GDP across world regions.

Emerging economies represent the biggest opportunities for road system development, but there are some worries about a possible slowdown related to sluggish growth in the advanced economies. Budget constraints will limit government investments on infrastructure, and the private sector may be called upon to contribute in traditional public sector spaces. However, the crisis has affected the number of users willing to pay too; so good governance of existing road systems and innovative financing mechanisms for new projects become primary.

Traditionally road infrastructure funding has been primarily borne by the public sector either using money from the general budget or funds from other particular sources (local taxes, fuel taxes, taxes on new vehicle acquisitions, and vehicle registration licenses). Given the shortage of funding because of the impact of the global financial crisis (reduction of taxes), the role of the private sector has been steadily increasing. Many countries turn to tolling as a primary way to raise funding, and advancement in technology are opening the way for future financing methods (extending tolling to the full network, “free-flow”, user-charging models based on road use). Road Authorities have also increased the range of contractual arrangements to engage the private sector.

Public-Private Partnerships (PPPs) have been one of the solutions identified. PPPs comprise various schemes (BOT, DBFO) differentiating on financial and contractual obligations, but the key common feature is the sharing of the risks between the public and the private entity. PPPs may also generate improvements in operative efficiency through better management. They are however, complex, heavily dependent on traffic and revenue forecasts and so often successful only if applied to main road projects.

Generally, the cost of private financing (and expected equity rates) are decreasing, but there are still difficulties in accessing credit. It seems as if different financing mechanisms and guarantees are to be put in place by governments or financial institutions in order to enlarge and secure private financing. Innovative financing mechanisms can consider capital instruments (investment funds, development banks, and state infrastructure banks), debt instruments (credit assistance, corporate bonds, and guarantees) or other innovative methods (value capture).

The objective is to provide risk capital or bank credit to projects of common interest. For example, in the EU, it is pursued by the use of project bonds and principal risk-sharing instruments such as LGTT (loan guarantee instrument for TEN-T projects) to finance transport projects involving investors in the long term. PPPs and other private sector financing mechanisms ought to be seen as a supplement to traditional public funding rather than as a substitute. Finding the perfect balance between public and private funding will be the greatest challenge worldwide over the coming decades.

Francesco Micci,

For the full report, please contact the IRF – Young Professionals Programme