Sandvik’s Thomas Schulz talks to Claire Symes about market recovery in construction. In the three years since the last CONEXPO-CON/AGG exhibition, the construction industry has been through a tremendous change triggered by the global economic downturn. “At the time of the last exhibition in 2008, it was already clear that there was a levelling out occurring in the market,” said Sandvik president of construction Thomas Schulz. “But it was in October that year that the economy went into freefall after the col

March 19, 2012

Read time: 3 mins

Sandvik’s Thomas Schulz talks to Claire Symes about market recovery in construction

In the three years since the last CONEXPO-CON/AGG exhibition, the construction industry has been through a tremendous change triggered by the global economic downturn. “At the time of the last exhibition in 2008, it was already clear that there was a levelling out occurring in the market,” said“Sandvik was already prepared for a significant recession with a 10 to 20% fall in the market over a few years but no one had anticipated a 40% fall in the space of a month.”

According to Schulz, the rapid decline made for a difficult adjustment for many of its customers but he believes that there are signs that recovery is now underway.

“The construction sector will always be a cyclical business and there has been a traceable eight to 10 year cycle since the end of the Second World War,” he said. “Normally there will be a boom over a six year period with a decline over a two to three year timespan.

“However, the big issue was that it wasn’t a recession caused by a lack of demand, it was triggered by a lack of money.

“The recession has changed the economic centre of gravity and shifted the balance from the western world to the south east. In 2009, China accounted for 45% of equipment purchases and that was not the case before and has had a big impact on the sector.” While Schulz does not believe this year will be a return to the boom, he said that the industry is back on the path to growth.

“In 2009 dealers were reducing their inventories in order to free up cash,” he said. “Last year we saw demand for new equipment increase as restocking got underway, which has helped the industry but this kind of growth is not sustainable. I think it will take until the end of this year or early 2012 before we see continued growth.

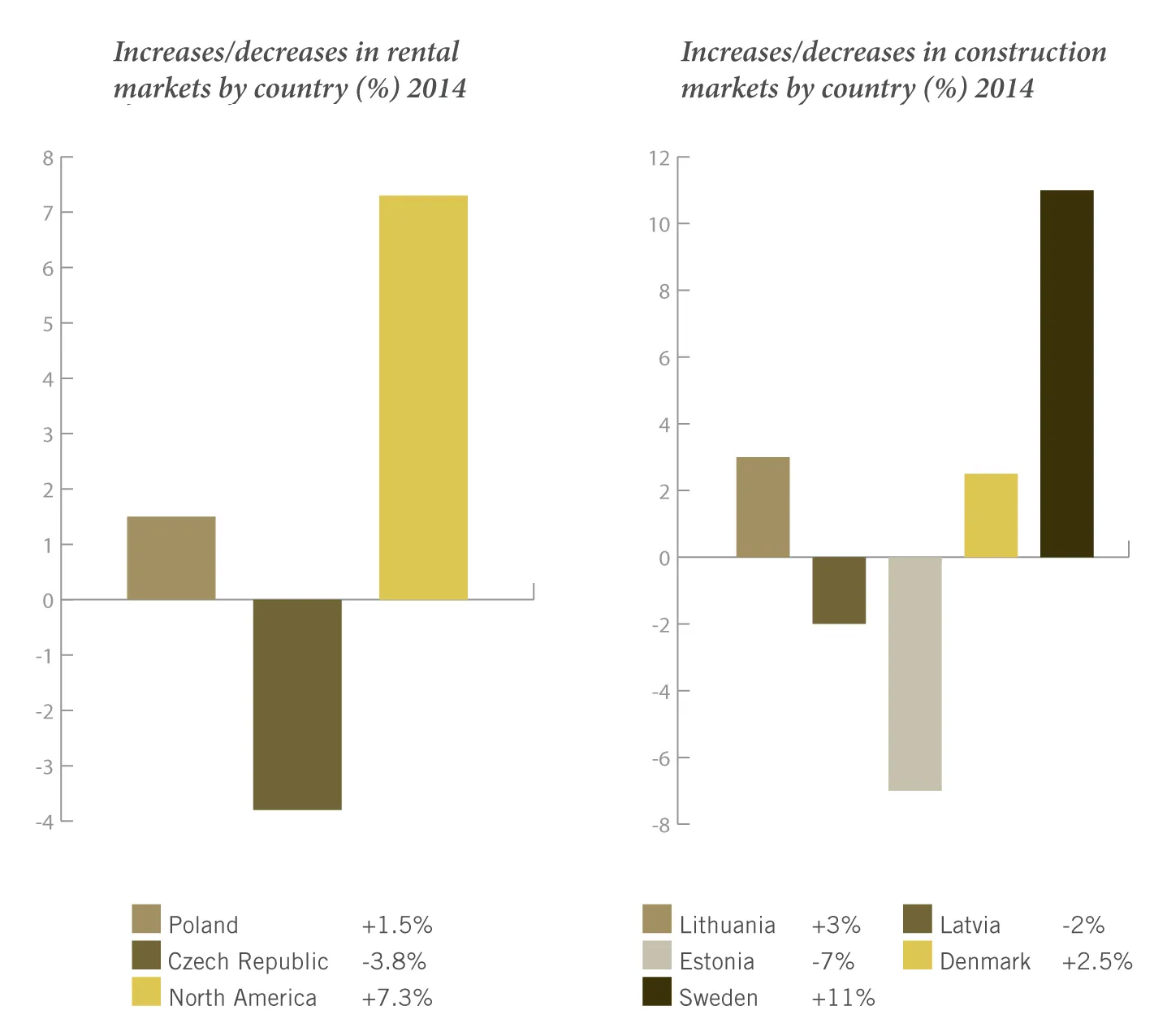

“North America always rebounds quicker than Europe mainly because investment in Europe is more fragmented with different policies in each country. We are seeing the economies in Germany, Sweden, Poland, Turkey, France and even the UK beginning to perform well.”

While Schulz believes recovery is underway, Sandvik is still trying to support its customers to make the most of their existing operations in a bid to maintain profitability. A key part of this is the company’s Quarry Academy initiative, which it is running with explosives specialist Dyno Nobel, in a bid to educate customers about how improved drilling and blasting operations can improve the whole operation of the quarry.

“In the past a lot of people have specified the primary crusher based on the largest particle size but improvements in drill and blast can mean increased productivity. We are encouraging customers to view drill and blasting as chemical breaking,” said Schulz.

Sandvik was offering visitors to CONEXPO-CON/AGG the opportunity to take a taster session for the academy and Schulz said that the initiative had proved popular with the crowds at the show.

“As a result of the initiative, one customer reorganised his quarry without making any new investment and achieved 15% more productivity,” explained Schulz.

What is clear is that while the much needed economic recovery is starting to happen, Sandvik understands that customers will continue to need cost-effective solutions both now and in the future.