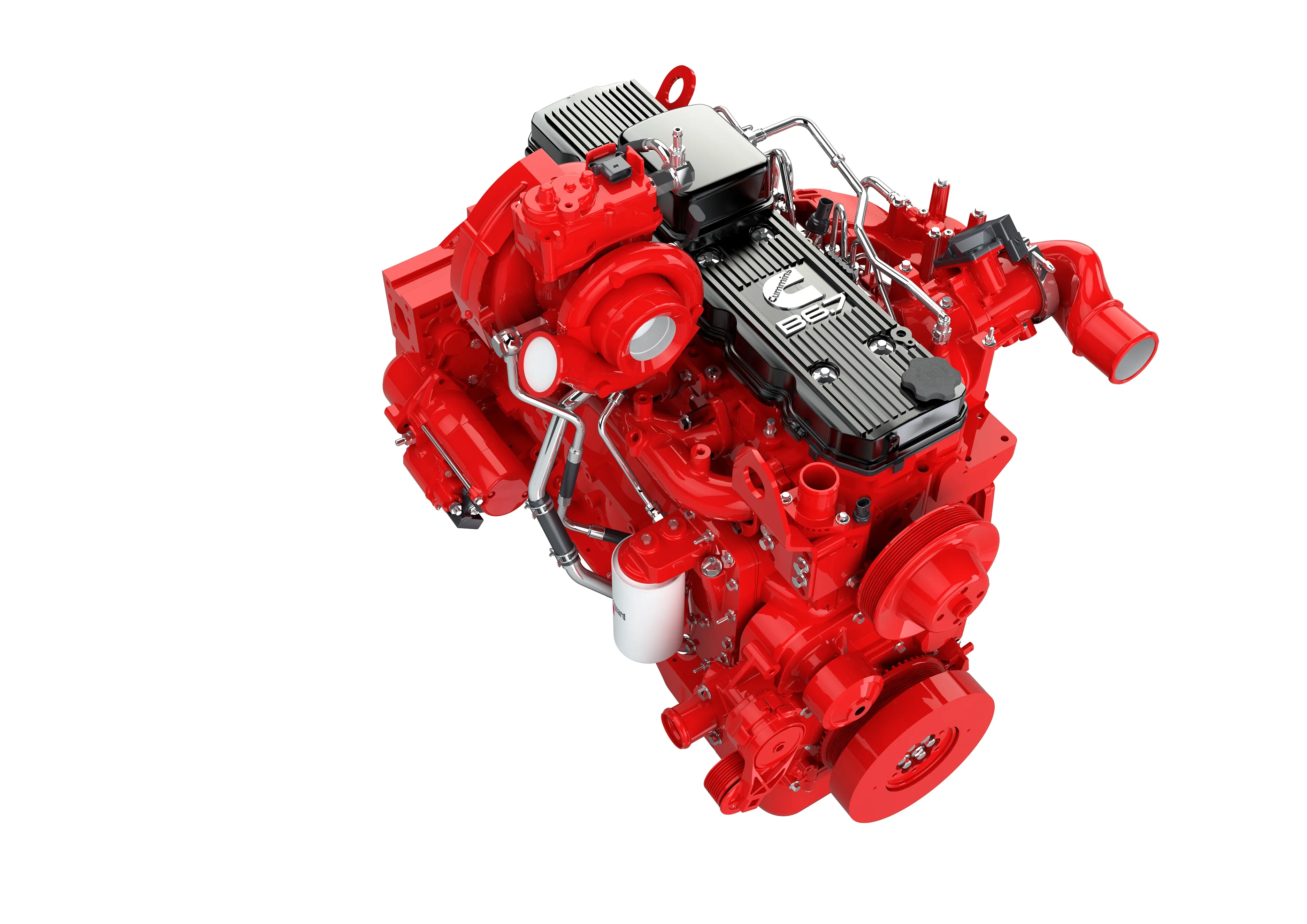

German engine maker

The firm’s new orders amounted to €1,556.5 million, up by 23.4% on the prior-year figure of €1,261.4 million. All of the major application segments, including the service business, registered an increase in new orders.

Almost 162,000 engines were sold, equating to a year-on-year rise of 22%. Revenue amounted to €1,479.1 million, up by 17.4% compared with the figure of €1,260.2 million for 2016. The rise in revenue was 21.9% in the EMEA region (Europe, Middle East and Africa) and 11.9% in the Americas region. Revenue in the Asia-Pacific region was on a par with the prior year.

Operating profit (EBIT before exceptional items) climbed by 81.2% to €42.4 million in 2017. The EBIT margin (before exceptional items) stood at 2.9%, compared with 1.9% in 2016. Net income advanced from €16 million in the previous year to €121.2 million in 2017.

The equity ratio saw further improvement from 46.3% to 49.4%. Free cash flow increased sharply, from €4.7 million to €82.5 million, even after taking into account the acquisition of Torqeedo – in order to accelerate implementation of the electrification strategy – and DEUTZ Italy (formerly IML) in 2017.

“2017 was a very successful year for DEUTZ. We have made improvements to our operating performance, got people excited about the new era we are about to embark upon and mapped out the strategic course we intend to follow. The aim with our new E-DEUTZ strategy is to become market leader for innovative drive systems in the off-highway segment,” said Dr Frank Hiller, chairman of the Deutz Board of Management. “We now need to keep the momentum from 2017 going. I am very optimistic that Deutz will continue its success in 2018 and that we will achieve our targets.”

For 2018, the company expects that the engine business will continue to benefit from the robust global economy and positive unit sales trends in key application segments. Consequently, the firm forecasts a marked increase in revenue and a moderate rise in the EBIT margin before exceptional items.

Deutz bullish with strong results

German engine maker Deutz reports a strong financial performance for 2017, with a marked increase in new orders, revenue and operating profits. With a view to the future, the firm is also positioning itself as a leader for innovative drive systems for off-highway applications.

The firm’s new orders amounted to €1,556.5 million, up by 23.4% on the prior-year figure of €1,261.4 million. All of the major application segments, including the service business, registered an increase in new orders. Almost 162,000

March 14, 2018

Read time: 2 mins