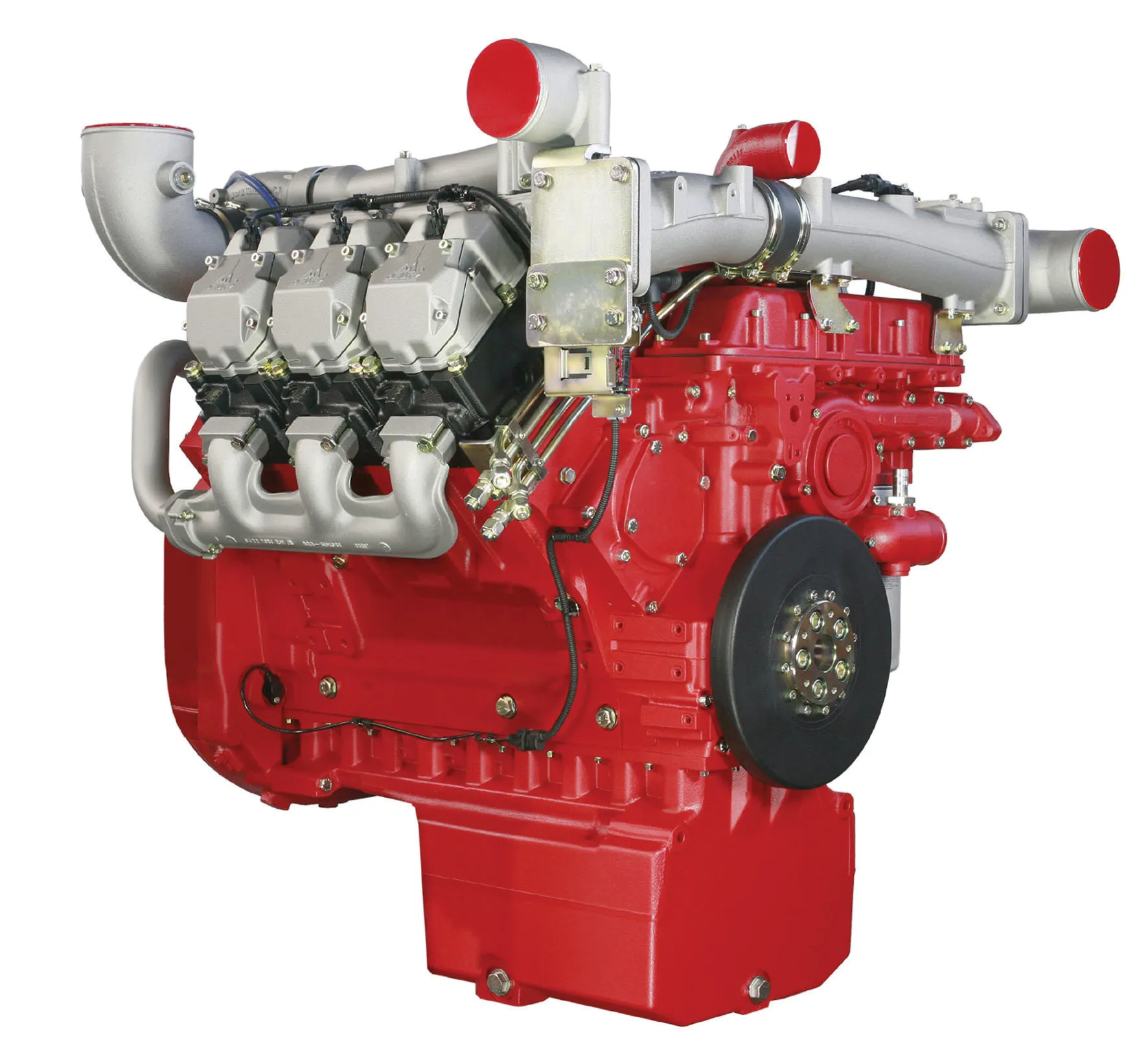

Volvo Penta has started production of industrial engines for the power generation market at the Volvo Group’s facility in Curitiba, Brazil. A new production line has been set up at the plant for the Volvo Penta engines, which include the 13litre TAD-1344GE and TAD-1345GE models.

Ron Huibers, president of Volvo Penta of the Americas said, “One of Volvo Penta’s ambitions is to improve our global supply chain for our products with competitive lead times, at a competitive cost. By producing these industrial

July 1, 2016

Read time: 2 mins

Ron Huibers, president of Volvo Penta of the Americas said, “One of Volvo Penta’s ambitions is to improve our global supply chain for our products with competitive lead times, at a competitive cost. By producing these industrial engines in Brazil, we’ll be offering an added benefit to our customers in South America.”

Gabriel Barsalini, head of Volvo Penta South America added, “Localising the production of industrial engines within the Volvo Group’s world-class manufacturing facility is part of Volvo Penta’s growth strategy in South America.

The power generation segment (stand-alone production) is growing in importance, particularly in Brazil, given that the demand for energy is higher than supply.

In the last two years, Volvo Penta has worked in structuring the after-market service delivery for the leading OEM genset builders in the region.

“Before beginning production of the engines in Brazil, we worked on establishing a support network for our customers, which is fundamental for the delivery of quality and for the success of our business,” said João Zarpelão, Volvo Penta South America industrial engine director. “Volvo Construction Equipment distributors Tracbel, Link and Entreposto have similarities with the Volvo Penta business, which will drive gains of scale for us.”

Volvo Penta’s business plan in South America addresses increased engagement with potential partners in the countries of Ecuador, Bolivia and Paraguay.