Revenue for the first quarter of 2017 was €352.5 million, an increase of 17.4% over the €300.2 million for the first quarter of 2016 and 12% higher than in the fourth quarter of 2016 when revenue reached €314.7 million. The firm’s Europe, Middle East, Africa (EMEA) region saw strong revenue growth. However, revenue also improved in the Americas region but declined slightly in the Asia-Pacific region.

At €7.6 million, operating profit (EBIT before exceptional items) was on a par with the first quarter of last year. However, the figure for the prior-year period had been boosted by a contribution of €5.5 million from a licensing transaction in the DEUTZ Customised Solutions segment. Compared with the fourth quarter of 2016, EBIT before exceptional items went up by €3.9 million.

Free cash flow also improved by a substantial €68.6 million to reach €39.7 million. As the premises in Cologne-Deutz, which cover an area of around 160,000m2 are no longer required following the site's relocation to Cologne-Porz, DEUTZ sold the land to the Düsseldorf-based project developer GERCHGROUP. The former industrial site, which is close to the Rhine, is to be redeveloped to create a new city district. Dr Margarete Haase, chief financial officer at the company said that the firm expects to receive a sum of around €125 million as purchase consideration this year.

"We have made a successful start to 2017. New orders increased in all regions and application segments. The inflow of funds provided by the sale of the site opens up new opportunities for investing in our growth and the strengthening of our core business," said Dr Frank Hiller, chairman of the firm’s board.

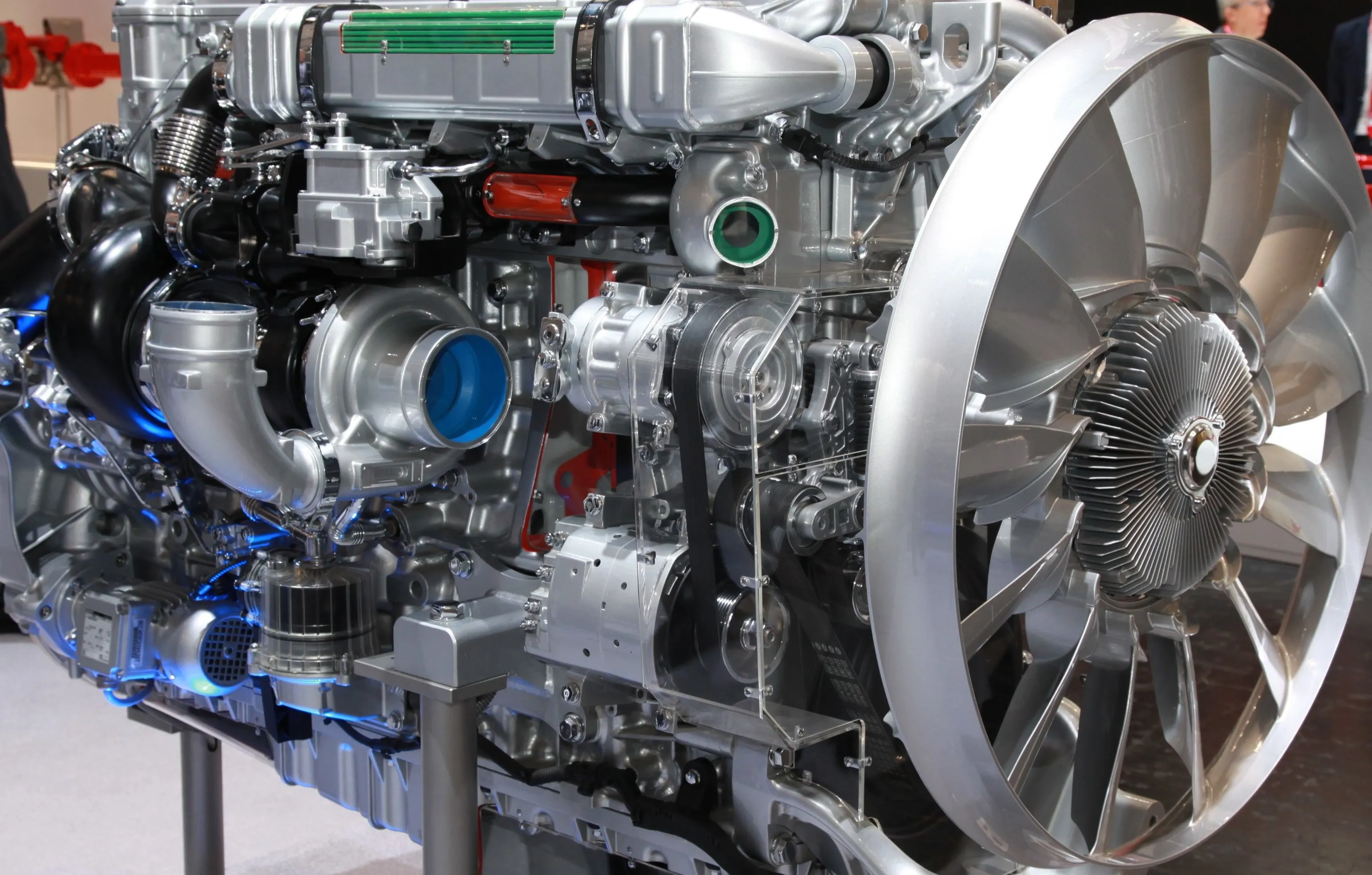

Deutz announces strong results with interim management statement

German engine maker Deutz reports a strong performance with its interim management statement for the first quarter of 2017 today. New orders rose significantly to reach €403.2 million, a 23.2% increase over the same period in the first three months of last year when orders hit €327.3 million. The figures also showed a 23.6% growth over the figures for the previous quarter when new orders reached €326.1 million. The firm sold 37,153 engines, an increase in unit sales of 15.7% over the same period for 2016 wh

May 12, 2017

Read time: 2 mins

German engine maker 201 Deutz reports a strong performance with its interim management statement for the first quarter of 2017 today. New orders rose significantly to reach €403.2 million, a 23.2% increase over the same period in the first three months of last year when orders hit €327.3 million. The figures also showed a 23.6% growth over the figures for the previous quarter when new orders reached €326.1 million. The firm sold 37,153 engines, an increase in unit sales of 15.7% over the same period for 2016 when 32,112 diesels were sold as well as for the previous quarter when sales hit 32,100 units.