The supply and demand for bitumen around the world is changing; refineries, suppliers and contractors must all make changes too - Kristina Smith reports

These are interesting times for those supplying and buying bitumen. Almost every part of the picture is in flux: global demand is shifting dramatically; major suppliers are following demand; refineries are closing down or stopping production of bitumen.“In Europe and globally there is a very big chain of events happening,” said Bernd Schmidt, CEO of

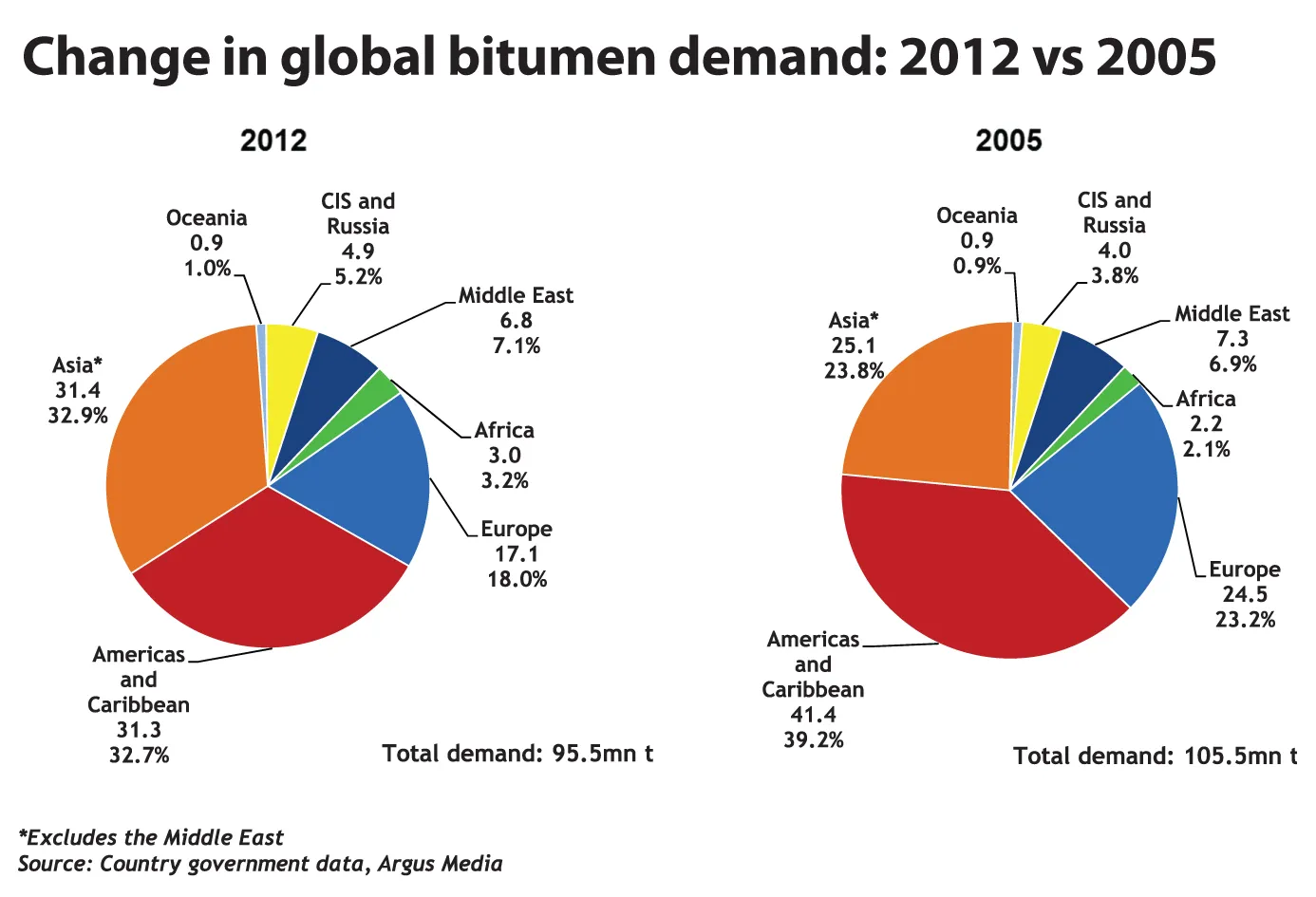

The last seven years have seen significant shifts in the demand for bitumen globally. In 2005, according to figures from

In 2012, Asia had just overtaken the Americas to become the biggest consumer of bitumen, with 32.9% of a total 95.5 million tonnes. Europe had slipped into third place with 18% (see pie charts below).

That picture is likely to change again in the coming years, as Asia’s share continues to grow. European refineries are already feeling the impact of Asia’s dominance in demand. The Financial Times reported in July that Russian oil shipments to Europe had reached a 10-year low, with Moscow setting up a deal to supply China through a new pipeline.

“All European refineries which process mid-heavy crude have problems sourcing raw materials and are buying at a premium light crude oil,” said Schmidt. Bitumen prices will be hit, “Prices will rise over the next three to five years immensely in Europe.”

While demand in Europe falls and Asia’s large slice of the pie continues to grow, Africa will be growing its small slice. “There is a tremendous amount of interest in Africa, with people looking to do more business there,” said Nasreen Tasker, global editor of the Argus Media’s Argus Asphalt Report who chaired and spoke at the 4th Argus Europe/Africa Bitumen conference held in Cannes on 12-13 June this year. “There are initial difficulties in getting into the market as some African companies require investment from the suppliers, but the growth is so great that everyone is looking for ways to get in.”

Firms such as Gilda Tar, set up in Dubai by Edman Nafrieh, are looking to exploit that growing demand in Africa. Speaking at the conference, Nafrieh highlighted statistics that make Africa so attractive.

Seven of the world’s 10 predicted fastest growing economies between 2011 and 2015 are African countries, said Nafrieh. And there is only 204km of road for every 1,000km2, only a quarter of which are paved, compared to 944km for the rest of the world, with over half paved.

Gilda Tar buys drummed bitumen from Bahrain, Saudi Arabia and Iran and sells it to customers in South East Asia, East and West Africa. In Africa the firm is supplying projects in Gabon, Uganda, Ethiopia, Cameroon and Congo. “Often customers in Africa don’t need big volumes, maybe 2000 to 3000 tonnes. So they can buy bitumen in tonnes together with a melting machine,” said Nafrieh.

Between 40% and 50% of Iran’s bitumen goes to the United Arab Emirates and GCC countries which then trade it on, according to Parya Karim, head of operation and logistics for Iranian bitumen supplier

Were the political situation to change so that shipping routes became open to Iran, Africa would be a growing market for Binas Energy, said Karim, “Africa is still a virgin market for us. But no one knows what will happen here tomorrow, so I can’t say what the situation will be like in five years’ time.”

Lifting of sanctions would see Iranian oil in demand in Europe, too, said Karim.

Coupled with the shifting global picture of supply and demand are improvements in technology which mean that many refineries are stopping the production of bitumen altogether. “Processes such as hydrocracking and coking mean that refineries can create higher value products from the heavy residues used to produce bitumen,” said Schmidt.

For some, bitumen just does not stack up economically. “Small, specialist refineries cannot justify the production of bitumen and are having to shut down,” said Tasker. “For integrated refineries, bitumen has to make money for them, otherwise they will look at alternatives; or some may switch to lighter crudes and therefore make less bitumen.”

In Europe, 13 refineries have closed in the last few years, Kurt Wynendale, BA director,

For those that resell bitumen, and those that use bitumen, these closures and changes in trading patterns mean uncertainty for both supply and prices. For contractors who are bidding for projects, sometimes years in advance, price fluctuations are bad news. “The sharp increases we have seen in prices, the volatility has not been good for contractors – or for resellers who have seen margins squeezed,” said Tasker. “Larger contractors who have the capital have been looking at the price volatility and creating more storage to give themselves flexibility, looking to do deals directly with refineries.”

This is a trend seen in China, the US and increasingly in Asia, said Tasker. However, refineries are sometimes reluctant to bypass resellers and deal directly with contractors as they need regular, reliable buyers for their bitumen.

The deal itself is just a small part of the bitumen buying process, however. “The reality is that bitumen is a very complicated product,” said Schmidt. “Very sophisticated equipment is required to transport, store and distribute bitumen from source to end-user.

“There is a huge supply chain with many complications as bitumen is a difficult product to handle...refineries, terminal owners, ship owners, ship brokers, container carriers, packaging companies, importers, distributors, modifying companies and many others. And doing business across borders requires an understanding of the cultural and technical issues involved.”

Schmidt does not see buying direct from refineries as a viable option for many contractors. “In the short- and medium-term, most of the contractors will not be able to buy the bitumen themselves and bring it to their destination in the right form and to the right specification. And they don’t want to take the risk of transportation and cash flow.”

Another result of the changing bitumen supply landscape has seen shifts to more flexible pricing during some periods, according to the Argus Asphalt Report. “Refineries have been less willing to provide long-term fixed prices for bitumen,” said Tasker. “So they have been switching from longer periods of time, say six months down to one month. Or even daily pricing, with a few refineries using the ‘price date of shipment’.”

Daily pricing could reappear should demand pick up again and production costs for bitumen continue to fluctuate, said Tasker. The standard period for refineries to fix prices is now a month, said Schmidt, with that period unlikely to change unless bitumen prices rise very dramatically.

With so many influencing factors, it is difficult to see what will happen next. Companies must be able to adapt fast to survive, said Schmidt. “Today markets are changing very fast. A successful bitumen company is the one that is the most flexible.”

The next of Argus Media’s three annual bitumen conferences will be the Argus Asian Bitumen Conference at Pan Pacific Singapore from 25-27 September 2013. %$Linker:

Pörner’s 9th plant for India

Austrian firm

The plant will process vacuum residue (VR) and heavy vacuum gas oil (HVGO) from the refinery and turn it into road paving bitumen of viscocity grades between VG-10 and VG-40. With a heat recovery system which sees energy retrieved from the flue gas to produce steam, the plant will be both energy efficient and meet the latest environmental standards, says Pörner.

Pörner’s contract is a turnkey one, including design, construction, commissioning support, start-up and licensing. Currently in the basic engineering phase, construction is expected to start on site in late 2014.

Logistics is the main challenge when installing plants in India, said Pörner’s head of marketing Lydia Brandtner. The firm supplies components from European manufacturers. “Even in times of developed global transport, the just-in time-supply of European equipment to India is a challenge,” she says.

This will be the ninth bitumen plant that Pörner has supplied to India. Even before this plant becomes active, 50% of India’s bitumen is produced in Biturox plants.