Changes to the way bitumen is produced and traded mean that traditional ways of specifying – and buying - it may not be enough - Frank Albrecht, MD of Albr3cht Supply Concepts, explained why to Kristina Smith

Traditionally, we have specified bitumen using two values: the penetration (pen) and ring and ball figures which define the hardness of the bitumen and its softening point respectively. Taking that approach today is risky, warns Frank Albrecht, managing director of Albr3cht Supply Concepts.

“It’s not enough to define a complex product by these two values only,” he said. “In the past it was, but not anymore. Every road builder should look into the quality of the bitumen he buys.”

This is because, in general, bitumen is now produced differently. It used to be a direct by-product of the oil refining process, made from the vacuum residues left after lighter products such as liquid petroleum gas, petrol and diesel have all been produced from heavy crude oil. The same refinery would use the same crude oil and produce the same sort of bitumen.

“That production route is almost history,” said Albrecht. “Now bitumen is blended out of different unwanted refinery streams. We are looking at a complex substance, made up from over 100,000 different hydrocarbons.”

There are a number of reasons why refineries are not producing bitumen now. Some may be using a lighter crude oil, which produces less residues. Others have invested in technology to upgrade the residues into more valuable products such as gasoline or diesel.

Some refineries may be producing bunker oils – used by ships – from the residues, rather than bitumen. Planned changes to the type of bunker oils which can be used in shipping are also impacting on refineries’ production decisions.

Many refineries have been closed down altogether, as oil companies demand that refineries be profitable in their own right. “A lot of refineries are pulling out of bitumen production,” said Albrecht. “It can be very difficult for big consumers to find a sustainable supply.”

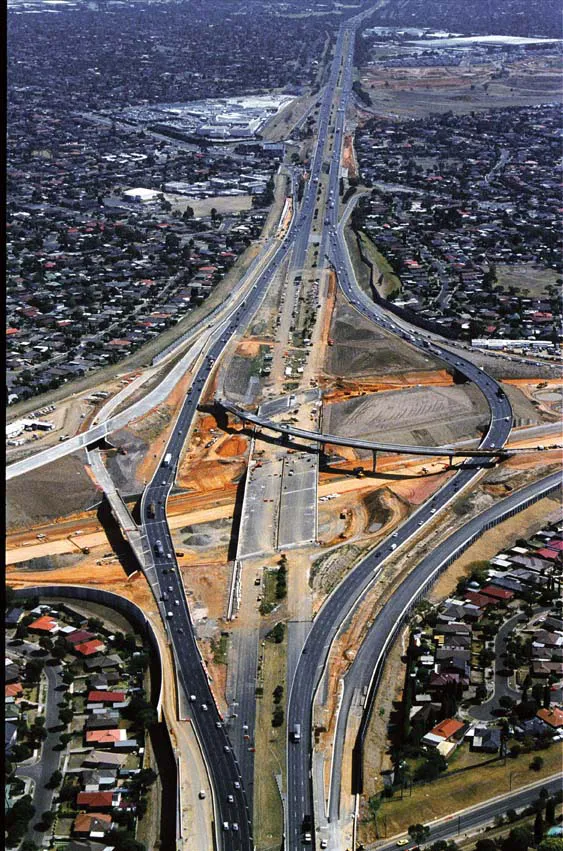

With the closure of refineries, particularly in Europe, bitumen is now travelling further. And with significant differences in bitumen prices between regions, new players are seizing the opportunity and entering the bitumen trading market.

“If a trader comes with an extremely cheap material, it’s cheap for a reason. Some people are buying a certain grade of bitumen and mixing it with used oil; you can add a percentage without noticing it. Because the product is badly defined by penetration and ring and ball, it makes it easy for those traders.”

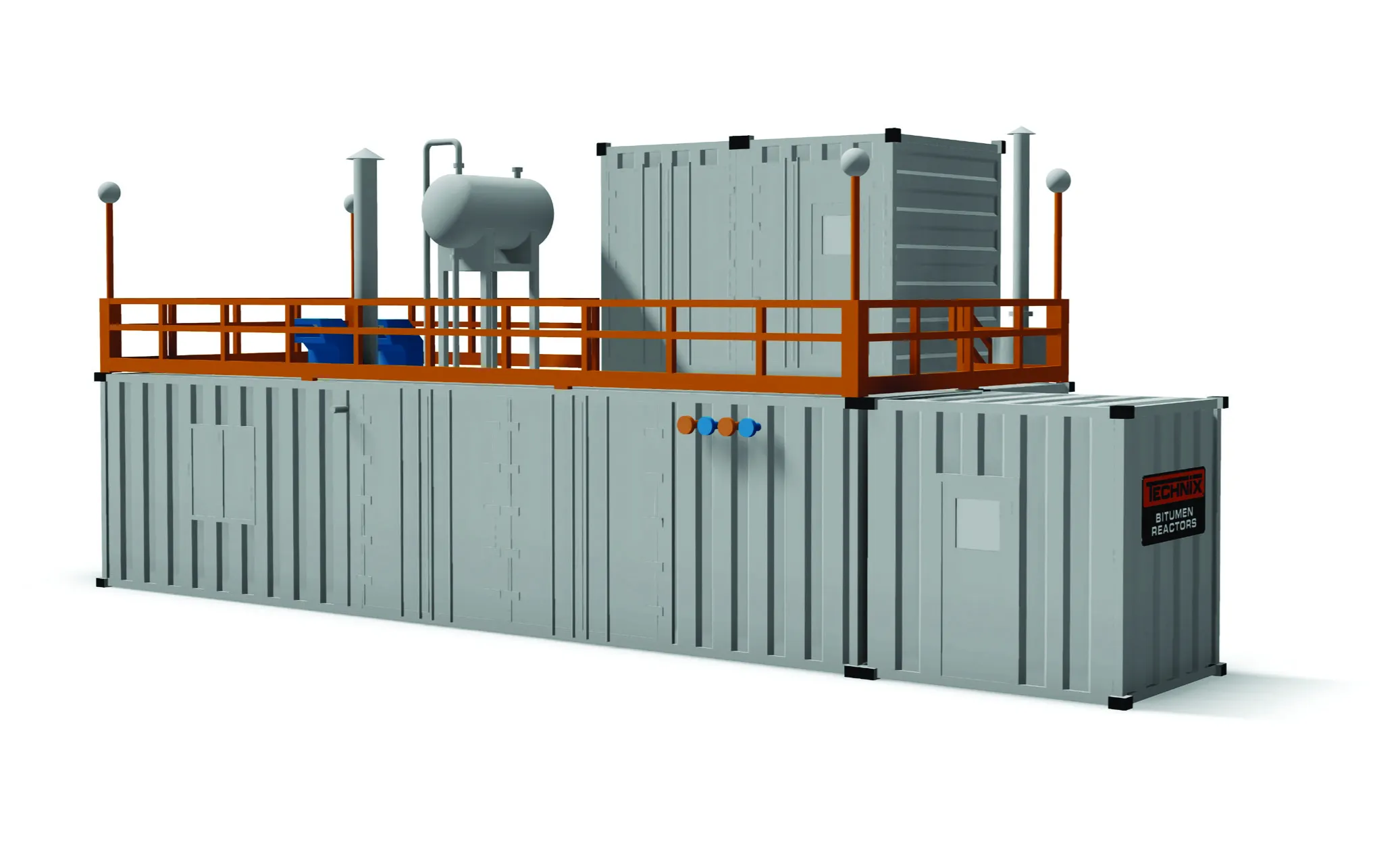

Having spent 12 years working for bitumen specialist Nynas, Albrecht set up Albr3cht Supply Concepts five years ago to help overcome these problems. He works with refineries which have residues from which they need to make profit, and connects them with contractors who need a sustainable, predictable supply of bitumen.

So, for example, when a refinery in Cape Town, South Africa, announced that it was reducing its bitumen output and might stop producing all together, South African bitumen company

Fluctuating costs

As well as the uncertainty around bitumen quality and performance, contractors are also facing constantly changing prices. “This is much more of a problem now,” said Albrecht. “In the past couple of years prices are fluctuating much more than they used to.”

While some governments do include cost escalation clauses in their contracts, many do not. And even when they do, the escalation clause may apply to the whole project. So, though bitumen prices may have risen significantly, it might not be enough to push the total materials bill over the trigger value.

Escalating bitumen prices can even stop major road building programmes going ahead, said Albrecht: “Depending on how the prices are going, if there is a situation like we had in the past three to four months where bitumen prices doubled, building projects are going to be delayed or may not happen at all.”

The answer for a growing number of contractors is bitumen hedging. Hedging works like this: a contractor buys a fixed bitumen price with the hedger, continuing to purchase bitumen from its usual suppliers. If the price of bitumen rises, the hedger sends financial compensation to the contractor; if it falls, the contractor sends the compensation to the hedger.

Specialist firms such as

Bitumen hedging is a relatively recent activity, which has only started to take hold in the last two years. The practice is more popular in Europe but also takes place in Southern and Northern Africa.

For contractors, it is a way of adding value to a tender, said Albrecht: “Funding, or lack of funding, is a big problem for many countries at the moment. With a hedging deal, contractors can assure the client that the budget they priced will buy the road.”