Italian attachment manufacturer

“There is definitely room for growth here,” said Indeco marketing and commercial director Michele Vitulano. “Look at the grab: it’s just starting to be used in the US.”

Then there is President Donald Trump’s proposed multi-billion dollar infrastructure plan. “In the past 30 years in the US, nothing has been done,” Vitulano said. “They need to start again and reinvest in this country.”

Indeco’s market and market share has been growing in the States over the past decade so that it is now the number two supplier. US sales account for over half of the company’s turnover.

“In our niche industry, the crisis in the US came earlier. In 2005-06 there was a big drop in hydraulic hammers and attachments sold in the US; after that the US market was recovering pretty quickly and the European market was dead,” said Vitulano.

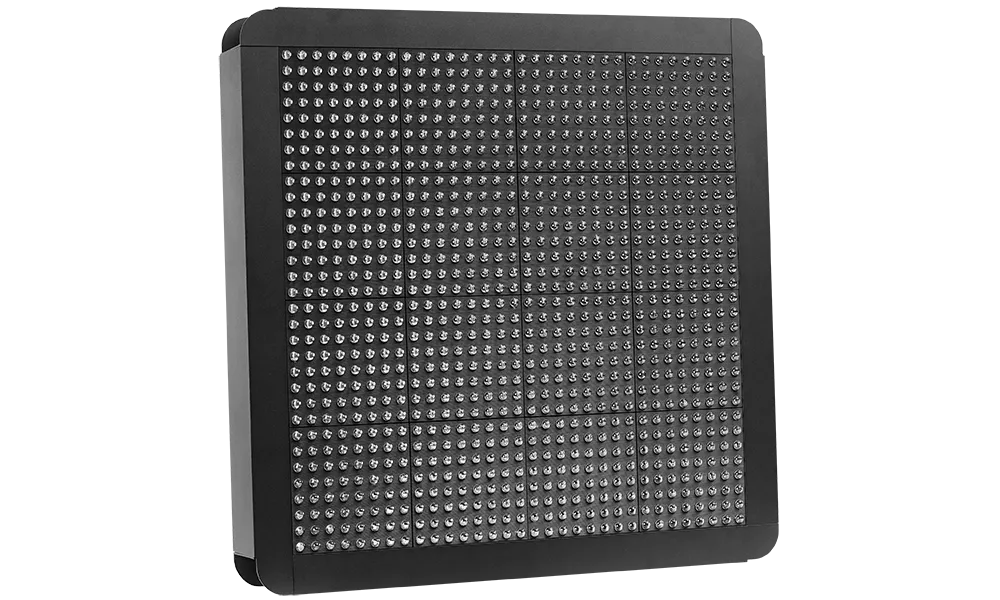

Indeco’s US business is based in Connecticut and has a manufacturing facility which currently makes hydraulic compactors. “The idea is to look at the possibility of doing more manufacturing in the US,” he added. “We made a big investment 10 years ago; it is a huge premises and we have room to grow.”

Vitulano hints that he wants to extend the company’s range of products, though he doesn’t know yet whether this will be through acquisition or through direct investment in product development. “This is a dynamic market,” he suggested. “We need to understand what changes are taking place and what our opportunities and obstacles will be in the future.”

Important product lines currently in the US are steel shears to service the huge number scrap and recycling yards and the manufacturer’s boom system.

“The dimensions of crushing plants here in the US are crazy, bigger than any other part of the world including Australia. The booms we make for the US market are like an excavator boom.”