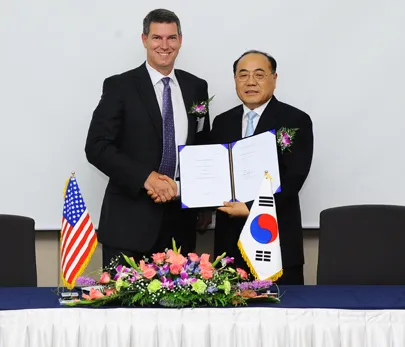

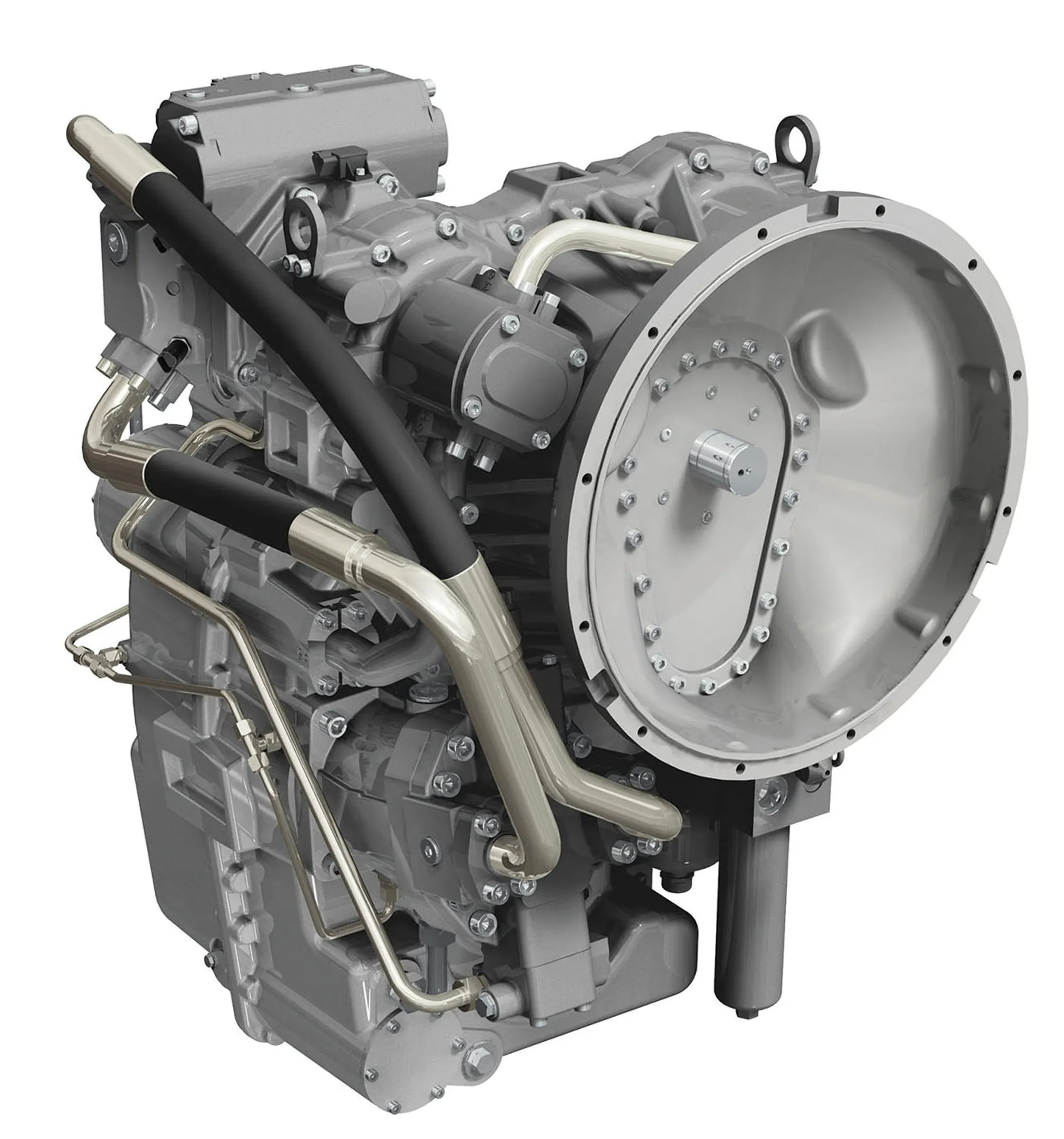

Hyundai Heavy Industries (HHI) and Cummins are setting up a joint venture to produce engines in South Korea for the earthmoving equipment market. The two companies are investing US$33 million each into the project, which will be called Hyundai Cummins Engine Company and will have its factory located in Daegu. Production is scheduled to commence in 2014, with capacity reaching 50,000 engines/year once the facility is fully commissioned.

September 26, 2012

Read time: 1 min