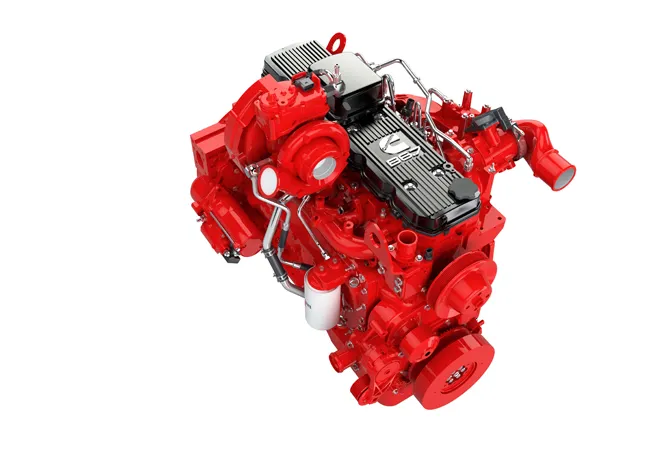

German engine manufacturer

The working capital facility totalling €160million is being provided by a syndicate of German banks. The credit line is unsecured and runs until June 2017.

In addition, Deutz has received a low-interest loan amounting to €90 million from the

"This syndicated loan and the loan from the European Investment Bank have enabled us to secure long-term funding for our projects and further growth. The stronger position in which the Company now finds itself has allowed us to further reduce our interest expenses for the next years and to significantly widen the range of options available to us", said Dr Margarete Haase, Deutz management board member responsible for finance, human resources and investor relations.

In June 2012 the