BICES 2015, China’s biennial international construction equipment show has made a series of step-changes by moving the venue to the New China International Exhibition Center (NCIEC) in Beijing, by bringing the timing forward from mid-October to September 22-25 2015 and by re-emphasising that the event continues to be run by the industry for the industry. Dressta vice president Howard Dale welcomed the initiatives saying it was right to hold the event where “many of China’s state-owned companies are headquar

April 21, 2015

Read time: 3 mins

According to Qiao Jian, general manager of the Beijing Asiamachine International Convention and Exhibition Centre, the show will go on tapping into China’s massive national infrastructure plan: “For a decade or more,” he said, “China’s construction machinery industry has enjoyed rapid development” from recent investments such as “8,400km of newly-built railways” and 112,000km of new roads and expressways. “Water transportation, civil aviation and pipeline construction have been further strengthened” says Jian, and “China has become the world’s most important country in terms of the sale and manufacture of engineering machinery.”

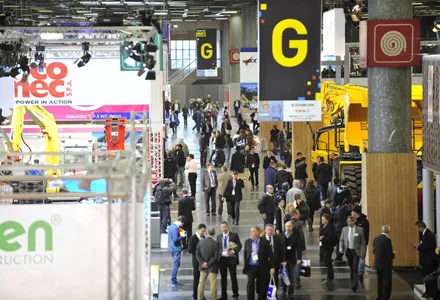

BICES pulls in 120,000 visitors, 1,200 exhibitors and takes up 200,000m² and will be “the Asia’s largest construction machinery exhibition in 2015,” says Jian. The organisers continue to stress that even though China’s rate of economic growth has slowed to the “the new normal,” the country still saw a GDP increase of 7.4% in 2014 with an output of US$10 trillion. And there are signs that construction equipment sales are on the up again with unit volumes increasing by 8.13% in the first quarter of 2015 versus 2014 as the country embarks on a series of developments in the Beijing, Tianjin and Hebei regions and the construction of Yangtze River economic belt.

“The export value (of China’s construction equipment sales) was US$3,288million in 2014, an increase of 18.3% over the previous year,” says Su ZiMeng, chairman and secretary general of the CCMA, the Chinese trade association. “The trade surplus was US$2,705million, up US$726million over the same period of the last year. And, among the export products, haul trucks, concrete mixer trucks and forklifts all witnessed great growth. Pneumatic tools, pile drivers, engineering drillers, tower cranes, truck cranes with the capacity of 100 tons above and other cranes all also experienced significant growth.”

In the year ahead, for instance, Jian predicts that “the investment in railway construction will be above US$130 billion and over 8,000km of new rail line will be put into construction.” He also thinks that the sector will benefit from “the construction of the Silk Road Economic Belt and 21st Century Maritime Silk Road.” Jian reckons China is on course to invest at least “US$800 billion in infrastructure construction in the Asian region every year.”

There will be a series of conferences and events running alongside BICES including The World Construction Machinery Industry Summit & T50 Forum, The International Rental Conference, The World Excavator Forum, The China-Japan-Korea Crane Symposium and The China Emergency Equipment Development Forum.