UK consultancy Amey has re-entered the Australian market with the acquisition of Premise, a consultancy operating in the transport, built environment, water and environmental/renewables sectors.

Amey retreated from the Australian continent in 2020 after a restructuring by its then parent company Ferrovial.

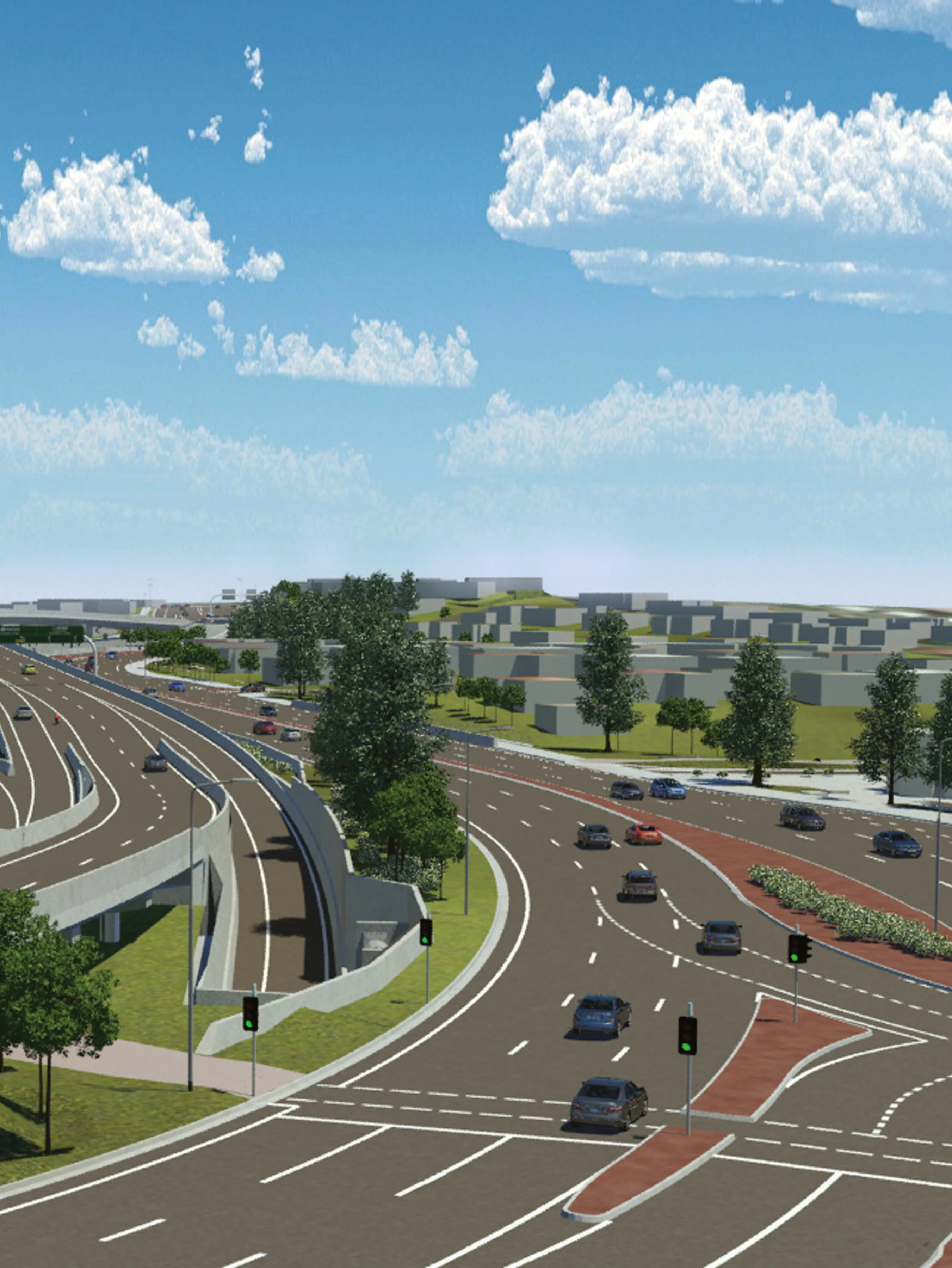

In 2013, Amey won a five-year, US$108 million highway maintenance contract for the Department of Transport and Main Roads in the Australian state of Queensland. For the contract, Amey was part of a joint venture with Leighton Contractors and Boral Construction Materials. The joint venture maintained and improved more than 1,000km of roads, including over 650km of state and national roads, from the south of Brisbane to the New South Wales state border, including the Gold Coast where the 2018 Commonwealth Games were held.

Amey split from Ferrovial in December 2022 and is now owned by private equity investors Buckthorn Partners and One Equity Partners.

A statement from Amey said Premise, based in Brisbane, “will provide a strengthened platform of digital and technical expertise and capability, providing an unrivalled range of services to new and existing clients in both the UK and Australia, New Zealand and other target geographies”.

“Our two companies share a common culture of behaving responsibly, ethically, and sustainably in everything we do, with a clear focus on the wellbeing of our people and the communities we serve,” said Andy Milner, chief executive of Amey. “Together, with their local knowledge and Amey’s scale, we are well positioned to accelerate growth, support jobs, and deliver cutting-edge infrastructure solutions that make a lasting impact.”

Earlier this year Milner hinted that some kind of acquisition was likely overseas, given slow growth in the UK for Amey. For the year ending December 2024, Amey UK group revenue was up only 1% from £1, 832.9 million to £1,850.6 million. But operating pre-tax profit was up a healthy 30% to £126.7 million.

In November last year, Premise merged with KCTT, a Western Australian civil and transport engineering Company. KCTT entered the market in 2011 as a boutique civil and traffic engineering consultancy. In the 12 years of operation, the company had grown to 20 staff with an office located in Balcatta, Perth.

In 2022, Premise picked up Southern Cross Consulting Surveyors.